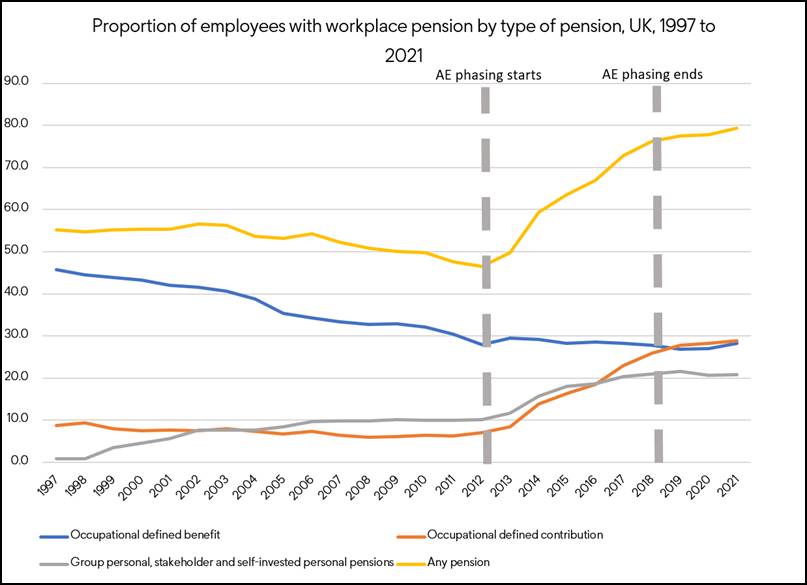

October 2012 marked a landmark moment in pension policy, when employers, in phases, were legally required to automatically enrol eligible employees into a workplace pension scheme. Over 10 years on from inception, the policy has been heralded as a success by government, addressing the challenge of decades of declining pension saving and the movement away from final salary (defined benefit) pensions.

When it comes to participation rates, there is very good reason to be positive. The latest available figures show 79% eligible employees in the UK are members of a workplace pension scheme, equating to 22.6 million people. Prior to auto enrolment, this figure was sitting at just 47%[1].

Graph: Office for National Statistics – Annual Survey of Hours and Earnings (ASHE)

However, while participation has improved significantly since 2012, the amount most people are saving for their future finances continues to be far short of what is needed for a decent retirement income. Modelling from Phoenix Group’s longevity think tank, Phoenix Insights, found there are around 14 million defined contribution (DC) pension savers who are not on track for the retirement income they expect (DC pensions are the schemes typically offered by employers to meet auto enrolment requirements).

And they’re not just slightly ‘off track’. The average size of the saving gap for this group is around £337,000, and for 68% of them the gap is bigger than £100,000[2].

Inertia: a double-edged sword

Under automatic enrolment, employees are defaulted into a pension at the statutory minimum contribution level. This includes a contribution from the employer alongside a personal contribution. Since 2012, the total minimum contribution has risen gradually from 2% of a band of earnings to the current level of 8%, where it has been fixed since April 2019 with no confirmed plans for further increases.

Employees can increase their personal contributions above the minimum however engagement among adults with workplace pensions is very low. Secondary analysis of the British Social Attitude survey by Phoenix Insights found 65% of UK adults know ‘little’ or ‘nothing’ about workplace pensions despite 78% acknowledge saving into a workplace pension is something they are ‘used to doing’[3].

The challenge of engagement centres around the behavioural principle that auto enrolment harnesses: inertia (or ‘going with the flow’). Eligible employees are defaulted into saving for their retirement without the need for action. While inertia has been important for boosting pension participation and low ‘opt out’ rates, it is a double-edged sword as poor engagement means people are unlikely to voluntarily increase contributions above the default level.

Addressing the under saving crisis

To tackle the under saving crisis there is broad consensus that we need to increase the default contribution rate from 8% to support people’s financial futures. But until now, there has been no discussion for how we do this in a way that that balances the interests of savers, employers and the wider economy.

Phoenix Group has looked to address this gap, partnering with WPI Economics to develop a framework to support policy makers determine how and when default contributions should increase from 8% to 12%. The framework forms part of the report, Raising the bar: a framework for increasing auto enrolment contributions, which lays out the economic and financial conditions that will enable the rise.

Asking individuals and businesses to increase pension contributions in the wake of a prolonged period of high inflation and a volatile macroeconomic environment is a crucial consideration. So acknowledging the costs to individuals and businesses has been one of the key principles for the tests for determining when contributions should rise.

It’s crucial this issue isn’t kicked into the long grass. We urge all political parties to commit to ensuring contribution rates are at the right level and address how they will do this in manifestos ahead of the next general election. And to ensure savings adequacy remains in the spotlight, there should be a regular statutory review for the government to assess whether savings levels are at the right level, measured against the framework we’ve laid out.

Increasing default contributions will make a material difference to people’s future retirement income. Inaction could leave generations of future retirees enter retirement unable to enjoy the lifestyle they hoped for, and at worst could mean millions more will end up relying on state support later in life.

Tim Fassam has served as the Director of Public Affairs at Phoenix Group since 2022. The Phoenix Group is the UK’s largest long-term savings and retirement business.