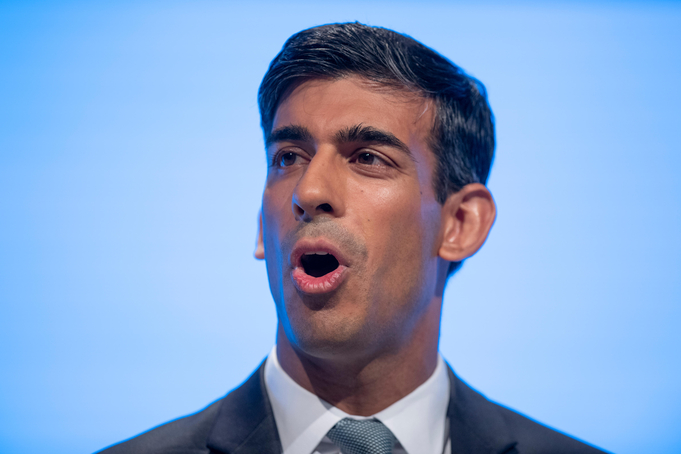

Chancellor Rishi Sunak has praised the UK jobs market as “robust” following fresh employment figures.

The new figures released by the Office for National Statistics (ONS) show that the number of pay-rolled UK workers rose by a further 90,000 (0.3 per cent) between April and May to 29.6 million.

While unemployment rate climbed from 3.7 to 3.8 per cent across the same period, it remained close to five decade lows.

Job vacancies soared new record of 1.3 million despite unimpressive growth.

Sunak said this morning: “Today’s stats show our jobs market remains robust with redundancies at an all time low. Helping people into work is the best way to support families in the long term, and we are continuing to support people into new and better jobs.

“We are also providing immediate help with rising prices – 8 million of the most vulnerable families will receive at least £1,200 of direct payments this year, with all families receiving £400.”

Pay excluding bonuses fell 3.4 per cent year on year in April, adjusting for inflation.

CPI inflation recently hit a 40-year high of 9 per cent as energy and food prices soared.

This marks the most dramatic decline since records started in 2001.

However across February and April real-terms pay plummeted to 2.2 per cent – the biggest dip since 2011, within the aftermath of the 2008 financial crash.

Liberal Democrat Treasury spokesperson Christine Jardine, said the figures ought to be a “wake up call” for ministers.

She went on: “This must be a wake up call for the Government to slash taxes now. Millions of squeezed-middle families are being dragged into financial despair because Rishi Sunak decided to clobber them with record tax hikes just as inflation spirals.

“This is now a cost-of-living emergency and the Government has no time to waste in cutting taxes. Every day of dither and delay heaps yet more pressure on household budgets.”

Greg Thwaites, research director at the Resolution Foundation, said: “Britain is in the midst of the highest inflation in four decades, and a recovery that has run out of steam. But we are not yet seeing a wage spiral as some are expected, but instead the deepest pay squeeze in over a decade.

“The labour market could now be at a turning point. On the one hand, vacancies are at a record high. On the other, unemployment has started to tick up. If this continues, families may start to find it harder to work more if they’re feeling poorer, but the Bank of England may feel more confident that it can avoid domestic inflation pressures spiralling,” he went on.

The Foundation further highlighted that short-term unemployment has risen over the past few months for the first time since 2020 and total unemployment actually rose in April. They also pointed out that typical pay for employees fell in May, offering the Bank of England reassurance that a wage price spiral is far from underway.

TUC general secretary Frances O’Grady said: “Working families deserve financial security. But real wages are falling off a cliff as the cost of living soars. Millions of workers are being forced to choose between paying their bills or feeding their families. That isn’t right. We urgently need action to get people the pay rise they deserve. That means boosting the minimum wage, a real public sector pay rise, and the government supporting – not attacking – unions who are campaigning hard for fairer pay.”

Professor Len Shackleton, labour market expert and editorial and research fellow at free market think thank the Institute of Economic Affairs that the figures “continue to paint a positive picture of the labour market, by contrast with the gloomy GDP figures. ”

“Total employment and the employment rate are up again, while the unemployment rate and economic inactivity are down. Pay is a mixed bag, with basic pay falling in real terms but with bonuses meaning some workers are up in real terms.

“Several of these indicators appear after a lag, and cover February to April, but payroll employment and vacancies offer a more recent perspective and also show a positive picture.

“The post-Covid labour market is continuing to adjust and there are still a lot of people changing jobs after a long period of lockdown. I would hope older worker economic activity will recover in the coming months, and self-employment – still way below its pre-Covid levels – should continue its modest climbback. However this depends on the way consumer and investment spending reacts in the face of rising inflation, and whether the government finds a way to reduce the growing burden of taxation.