G20 poses challenges for ambitious Darling

By Alex Stevenson

Persuading the G20’s finance ministers at tomorrow’s summit to commit to Britain’s ambitious agenda for financial regulation is appearing increasingly difficult.

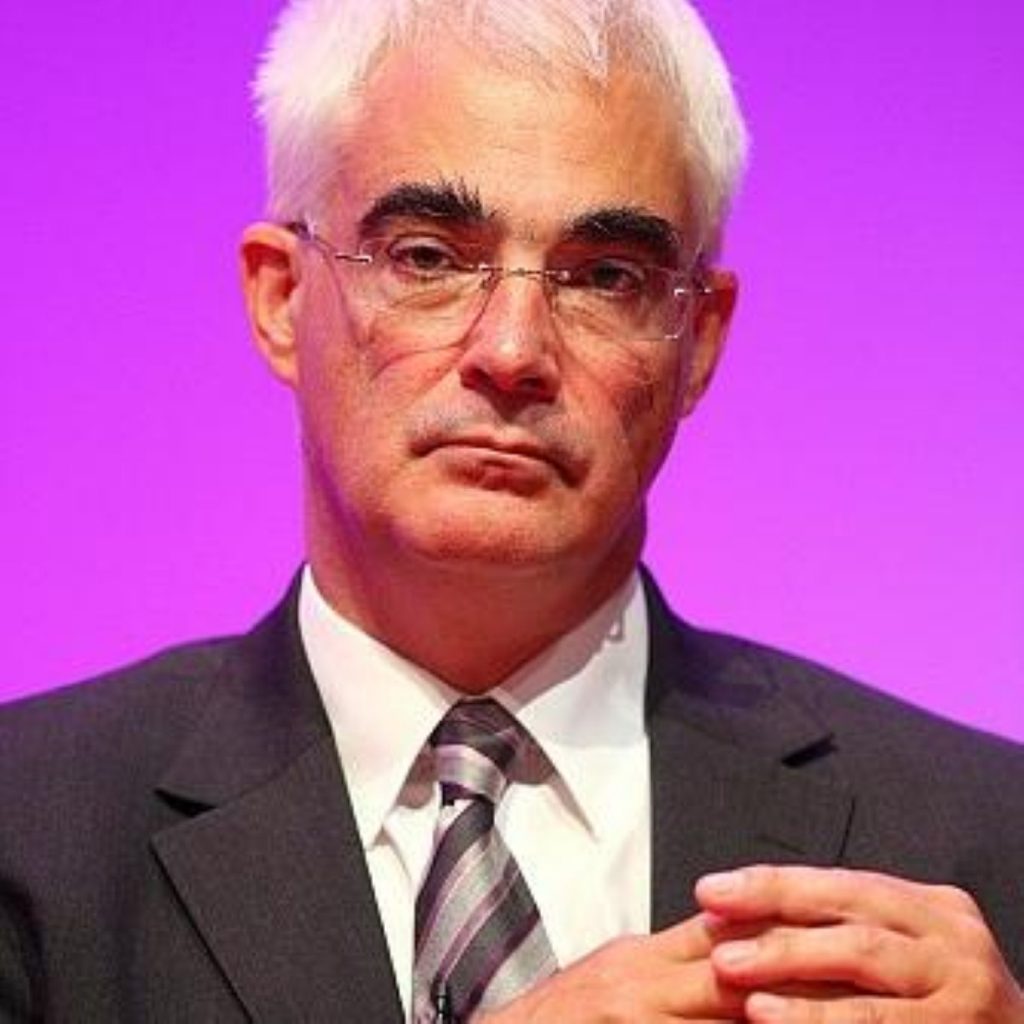

Chancellor Alistair Darling outlined the government’s ambitions in an opinion article for the Wall Street Journal newspaper.

But he faces difficulty in persuading his US counterpart, treasury secretary Timothy Geithner, of the need for concrete action.

Mr Darling calls for a range of measures strengthening global financial regulation.

“All types of risk to consumers, markets and economies need to be covered – including by joining up macroeconomic and financial oversight, opening up tax havens, and promoting transparency,” he wrote.

“We must better manage risks through early-warning capabilities and colleges of supervisors.”

Mr Darling also said it may be worth considering capping banks’ leverage ratios as a “backstop power to stop banks from overstretching themselves”.

Such proposals appear more advanced than those being considered by Barack Obama’s administration.

White House spokesman Robert Gibbs told reporters yesterday: “We’re not going to negotiate some specific economic percentage or commitment, but continue to talk about the notion that, as the president has talked for some time, that it is important that the world act together in growing our economy.”

He warned that people would have to “make changes” only after the main G20 summit, to be held in London on April 2nd, has taken place.

“Obviously the president looks forward to talking to leaders about a shared agenda to manage the crisis that we’re in, and to also prevent a future crisis from happening,” he added.

Mr Darling is seeking to play up the significance of the finance ministers’ meeting.

He wrote: “Only by working together can we meet the challenge. That is why this weekend’s meeting of G20 finance ministers in the United Kingdom matters.

“Together we represent more than 80 per cent of the global economy. No problem should ever be too great or too difficult for us to deal with.”

Mr Darling faces wider challenges tomorrow. He also called for increases to the IMF’s resources and backed “monetary loosening” and “fiscal stimulus” as the best methods of encouraging spending.

The G20 is divided over the positive impact of huge public spending, however, as seen in Britain and the US.

French president Nicolas Sarkozy was quoted by the Reuters news agency as saying: “We consider that in Europe we have already invested a lot for the recovery, and that the problem is not about spending more, but putting in place a system of regulation so that the economic and financial catastrophe that the world is seeing does not reproduce itself.”