Darling refuses to rule out Lloyds nationalisation

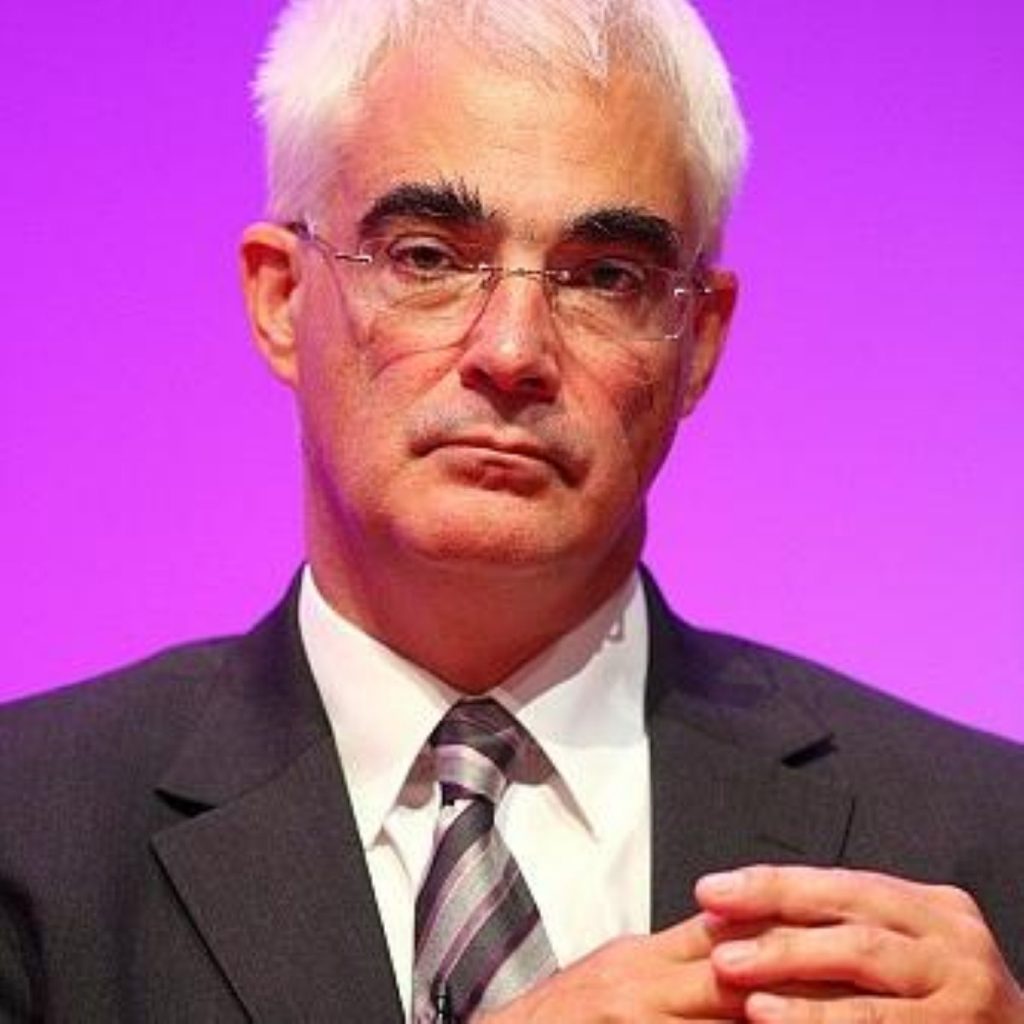

Alistair Darling has refused to rule out the possibility the government could nationalise Lloyds Banking Group – the company formed from the merger of Lloyds and HBOS.

The government encouraged Lloyds to take over its distressed rival after fears over the collapse of HBOS in October.

Lloyds’s shares lost 32 per cent of their value yesterday after HBOS revealed larger than expected writedowns on corporate lending. While Lloyds made a profit of £1.3 billion over 2008, HBOS’ loss of £10 billion has raised questions over the future viability of the combined entity.

Asked on BBC2’s Newsnight whether he would rule out the nationalisation of the bank, the Chancellor said the integrity of the banking system was the government’s overwhelming concern.

“I said in January there is a range of options that we will be deploying, a range of levers that can be pulled to help all banks, because I have made it very, very clear that the integrity of the banking system is very, very important.”

Mr Darling added that it was important to identify the problems faced by banks and to remove uncertainty in the system so as to encourage them to begin lending again.

Commenting on the reports, Liberal Democrat Treasury spokesman Vince Cable said: “It looks increasingly as if Lloyds HBOS will now go into majority public ownership, followed inevitably by nationalisation.”

Conservative shadow business secretary Kenneth Clarke went further describing the HBOS and Lloyds TSV merger as a “disaster” and suggesting they should never have been allowed to join forces.

Speaking on the Today programme on Saturday Mr Clarke also claimed the government’s initiatives to get banks lending again had failed.