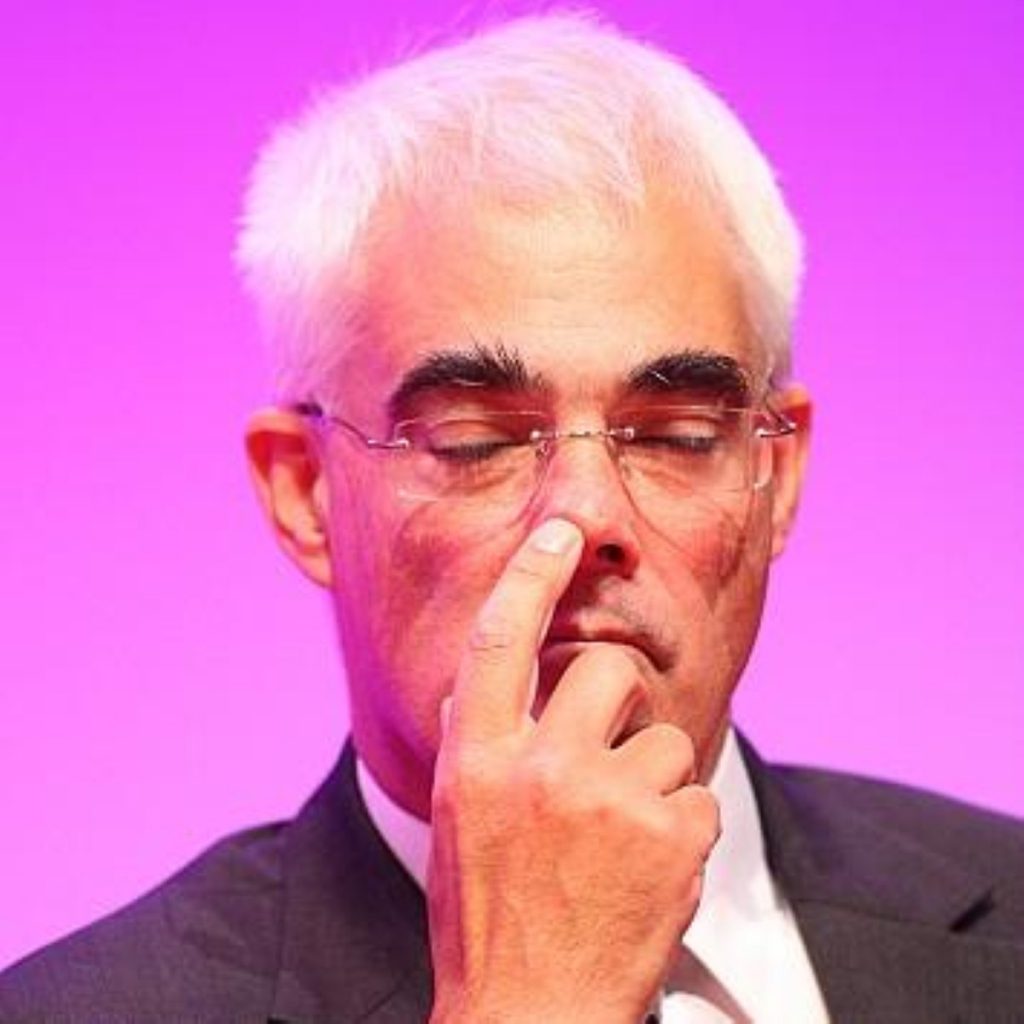

Darling ‘kept in the dark’ over short-selling return

By Ian Dunt

Chancellor Alistair Darling was only told the Financial Services Authority (FSA) would lift the ban on short-selling an hour before it happened, media sources have indicated.

Reports in the Guardian indicate Mr Darling was irritated by the decision to drop the ban, and urged the FSA to reconsider.

The chancellor does not have authority over the FSA’s decisions.

The schism between the chancellor and the FSA reflects ideological tensions between the three parts of the tripartite regulatory system – the Treasury, the Bank of England and the FSA.

Those differences first became apparent when Northern Rock collapsed, with the different bodies arguing over the correct course of action to take.

The FSA is understood to have told the Mr Darling an ‘oversight’ led to him only being told about the change an hour beforehand.

Figures in the Treasury believe the FSA was concerned about possible legal-action from hedge funds.

The chancellor believes the ban will have to be reintroduced given the volatile nature of the banking system.

Sources within the Treasury are refusing to comment on the story, as are spokespeople for the FSA who said: “We don’t comment on discussions we have with our tripartite partners.”