Lib Dems and Tories turn on Labour over inflation

Both opposition parties have launched a scathing attack on the government following new findings from the Office of National Statistics (ONS) putting the level of inflation well above target.

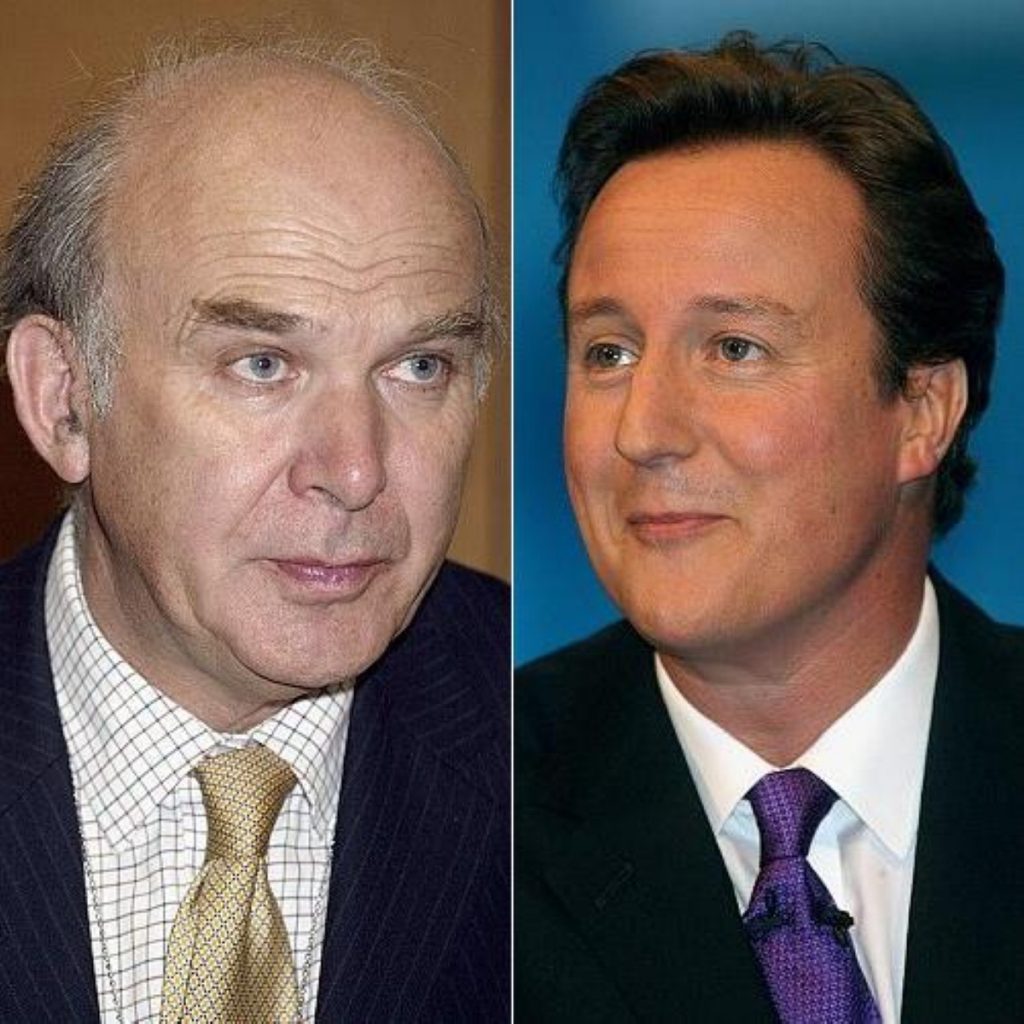

Shadow chancellor George Osborne said: “Inflation is now more than double the rate that Gordon Brown inherited from the last Conservative government.

“The official figures have caught up with everyone’s real experience of rising prices and a higher cost of living.”

Liberal Democrat economic spokesman Vince Cable said: “The prime minister bases his credibility on his economic record, yet it is now becoming startling clear he was asleep at the wheel.

“Gordon Brown is now facing the consequences of years of inaction over spiralling personal debt and the unsustainable bubble in the housing market.

“With inflation now well above its target, there is absolutely no hope of an interest rate cut in the near future, bringing yet more bad news to already hard pressed families.”

During June the consumer price index (CPI) – the measure used by government – increased to 3.8 per cent, well ahead of the official target, two per cent.

However, this remains below the level of four per cent expected for the EU as a whole.

The Bank of England has already conceded the CPI is likely to pass four per cent by the end of the year.

According to the ONS, the increase was precipitated by large increases in the price of food – with the impact of meat, fruit and bread and cereals particularly evident – and transport.

The average price of petrol increased by 5.3 pence per litre between May and June this year, to stand at 117.6 pence, compared with a rise of 1.3 pence over the same period last year.

This, along with a moderate increase in the price of air travel, has pushed the CPI ever higher.

Recreation and culture also saw a moderate increase in prices over the last year, while the cost of housing remained unchanged.

In contrast the ONS recorded a large downward pressure on prices from clothing and footwear, where discounting in a depressed high street was greater than last year.

Furthermore, there was a small downward pressure from alcohol – where the price of spirits decreased this year and the price of wine increased by less than last year.

Bank of England governor, Mervyn King, is under no pressure to write a letter to the chancellor of the exchequer, Alistair Darling, this month – despite inflation being well ahead of the two per cent target.

Mr King wrote to the chancellor last month, and is only required to do so once every three months.

Mirroring the CPI, the retail price index increased from 4.3 per cent in May to 4.6 per cent in June.

The ONS argues the same pressures were felt by the RPI as by the CPI.

However, there was a large additional downward contribution from housing on the RPI.

Mortgage interest payments were the main cause, where there was a smaller increase this year than last year and, to a lesser extent, from house depreciation.

Both mortgage interest payments and depreciation are excluded from the CPI.

“While the Bank of England will be disturbed by the June inflation data, it had access to the data when deciding to leave interest rates unchanged last week,” commented Howard Archer, of analysts Global Insight.

“The economic environment facing the Bank of England currently seems to be becoming more difficult by the day as new data and survey evidence indicate that the downturn is deepening and widening but inflationary pressures are continuing to rise.