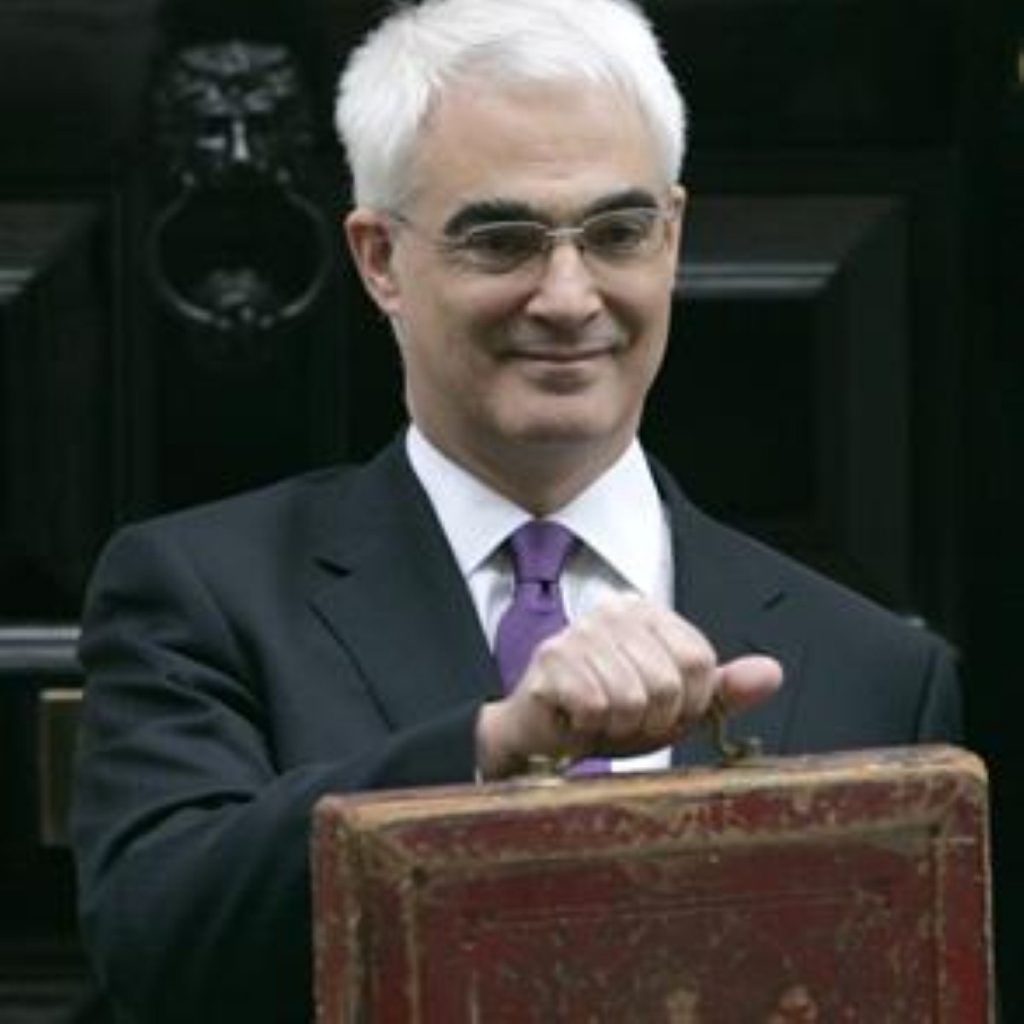

Darling delivers Budget 2008

Alistair Darling has delivered his first Budget, billed as a fair package designed to maintain long-term stability.

But the chancellor was unable to avoid the spectre of the global economic downturn, confirming that projections for UK growth have been cut to between 1.75 and 2.25 per cent.

Mr Darling told MPs he was delivering a “responsible Budget to secure Britain’s future in the face of global uncertainty”.

As was widely predicted, Mr Darling sought to distance his predecessor’s handling of the economy from the current turbulence, blaming instead a wider global downturn stemming from the US mortgage market.

As previously claimed by the government, the chancellor argued the UK is better placed to resist the global economic downturn, with low-inflation, low-interest rates and low unemployment.

In an early concession to the fuel lobby, Mr Darling confirmed widespread reports that the two pence rise in fuel duty will be delayed until the autumn, at an estimated cost of £500 million to the Treasury.

This was despite today’s Budget being trailed as the “greenest yet”. In an appeal to the environmental lobby, Mr Darling signalled his support for an 80 per cent cut in emissions in the forthcoming climate change bill.

As predicted, Mr Darling announced a tax on “gas guzzlers”, arguing it was right that motorists who choose to buy a more polluting car should be charged more.

Additional green measures from the chancellor included the threat of a tax on carrier bags in 2009 if supermarkets fail to take effective voluntary action. The money raised from this would be poured into environmental charities, he said.

With the government under pressure to prove its commitment to child poverty, Mr Darling announced a total additional spending of £765 million next year, rising to £900 million to tackle child poverty.

Despite being touted as a key priority for the chancellor, this underscored the tight fiscal environment, falling short of the £1 billion made available last year.

As expected, he also announced additional spending on failing schools including an £200,000 million investment to abolish failing schools through expansion of the academies programme and London Challenge scheme

Mr Darling finally moved to confirm his reforms of capital gains tax, corporation tax and the non-dom levy, amid last-minute lobbying from the City.

As set out in the pre-Budget report, he announced capital gains tax will be simplified next month to a flat 18 per cent rate, but with the exception of an entrepreneurs’ relief to offset criticism.

He also confirmed corporation tax will be cut to 28 per cent, ten pence above the rate demanded by the CBI.

Despite widespread criticism, Mr Darling insisted it was right that non-doms should be expected to pay a flat fee after seven years in the country.

In a surprise announcement, the chancellor countered criticism that charities will be adversely affected by last year’s announcement to cut income tax from 22p to 20p. They will now be able to claim Gift Aid at a transitional rate of 22p, he announced.