Cramped Darling faces subdued Budget

Chancellor Alistair Darling is preparing to deliver his first Budget later today amid the worst economic conditions faced by the Treasury in the last decade.

Rising utility prices and upward inflationary pressures are causing a slowdown which analysts say will severely curtail gross economic growth in 2008 and possibly beyond.

A cash shortfall, although unexpectedly alleviated in recent weeks, means the option of a cut in overall taxation levels is not open. Equally the strained situation means Mr Darling cannot afford to increase the tax burden.

As a result the chancellor is expected to raise revenues through the introduction of green taxes, an area seen as the least likely to attract a public backlash.

Potential measures include punitive increases on gas-guzzling 4x4s, switching aviation taxation from passengers to flights and the much-vaunted 2p-a-litre hike on petrol taxes.

Even these may need to be delayed by six months or longer in a compromise with environmental groups, it is predicted, with road groups calling for a petrol tax delay.

Consumers are already struggling, the AA and RAC argue, meaning the government should wait for the oil market to stabilise before implementing the extra duty.

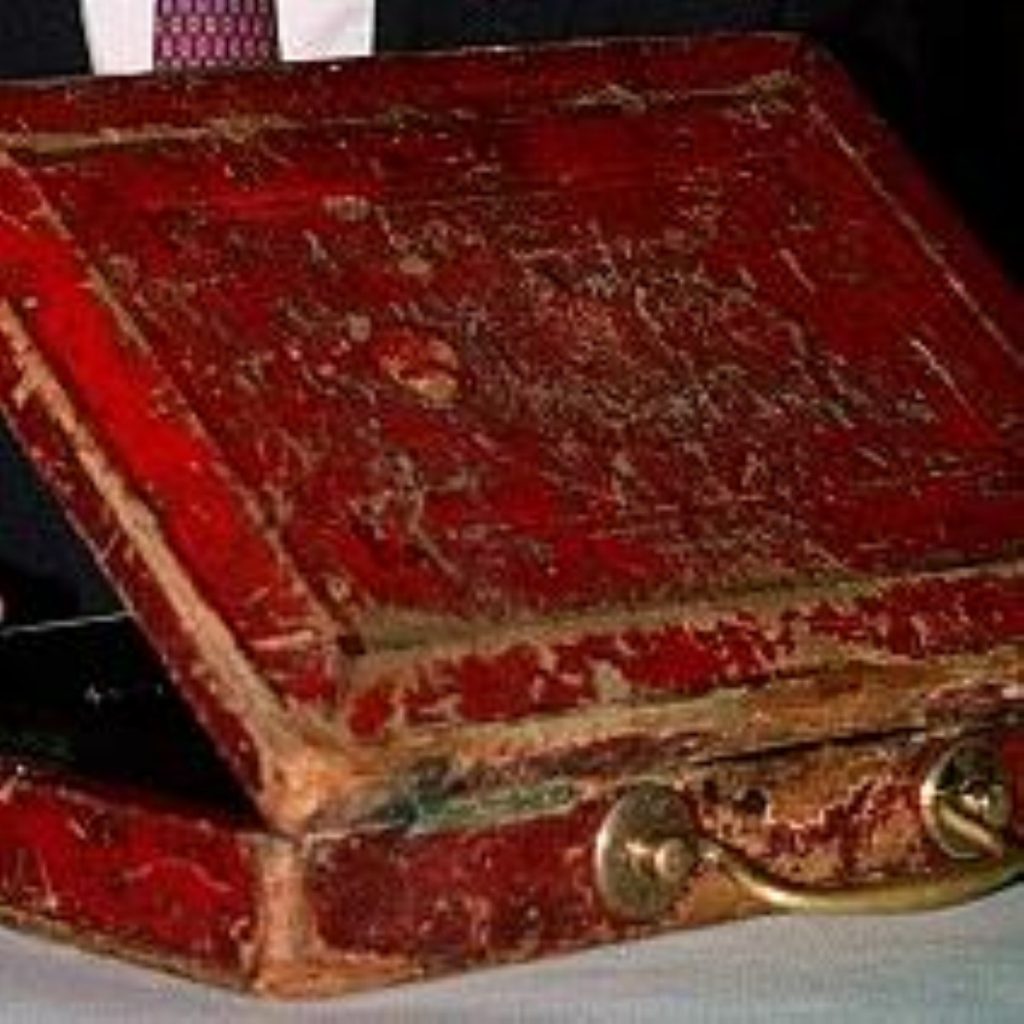

One of the most interesting question-marks hanging over Mr Darling’s red box is whether he will impose a windfall tax on energy firms. Profits thanks to the same market have soared in recent months.

Such a move is backed by unions, who say ordinary people do not understand the apparent unfairness of the situation, and environmental groups like Friends of the Earth.

No delays are expected for the usual ‘sin taxes’ on tobacco and alcohol duties, which will be implemented immediately as usual.

Concerns about binge-drinking will soften criticism on the latter and placate those like Alcohol Concern who believe such measures will save lives.

High on the agenda will also be tax credits, with the government under pressure to make good its pledge to halving child poverty by 2010.

Statistics suggest that target is likely to be missed but Mr Darling is expected to demonstrate the government’s ongoing commitment to the issue.

The chancellor may seek to tie in his efforts on that issue with fuel poverty, where campaigners have been pressing for alleviating action for the poorest.

The government is supposed to eradicate this in vulnerable households completely by 2010 and could enforce its statutory powers to cap the amounts charged on pre-payment meters.

A group of energy welfare organisations has pressed the government to address this “very urgent situation” and reverse a recent 20 per cent cut in funding for its main weapon for tackling fuel poverty, Warm Front.

The letter admits wider spending constraints may cause the problem, a theme likely to recur in different sectors throughout today’s Budget statement as a slowdown in consumer spending takes hold.

Declines in VAT and corporation tax revenues restricting Mr Darling’s spending power will be matched by falling stamp duty revenue, thanks to the stagnant housing market.

That is closely linked to the factors causing the Northern Rock debacle, whose nationalisation will hang over the Budget – even if it is only mentioned in passing with enhanced regulation of the City.

Mr Darling will be even keener to avoid the slip-ups on capital gains tax, non-domiciles and inheritance tax seen in his pre-Budget report.

They echoed Conservative proposals seen earlier in the autumn, delighting opposition politicians. Both the Conservatives and Liberal Democrats will be hoping Mr Darling makes similar mistakes when he steps up to the despatch-box at 12:30 GMT.