Tories woo business with new carbon tax

The Conservatives have launched plans for a new carbon tax in an effort to ensure their new focus on the environment does not damage their traditional business links.

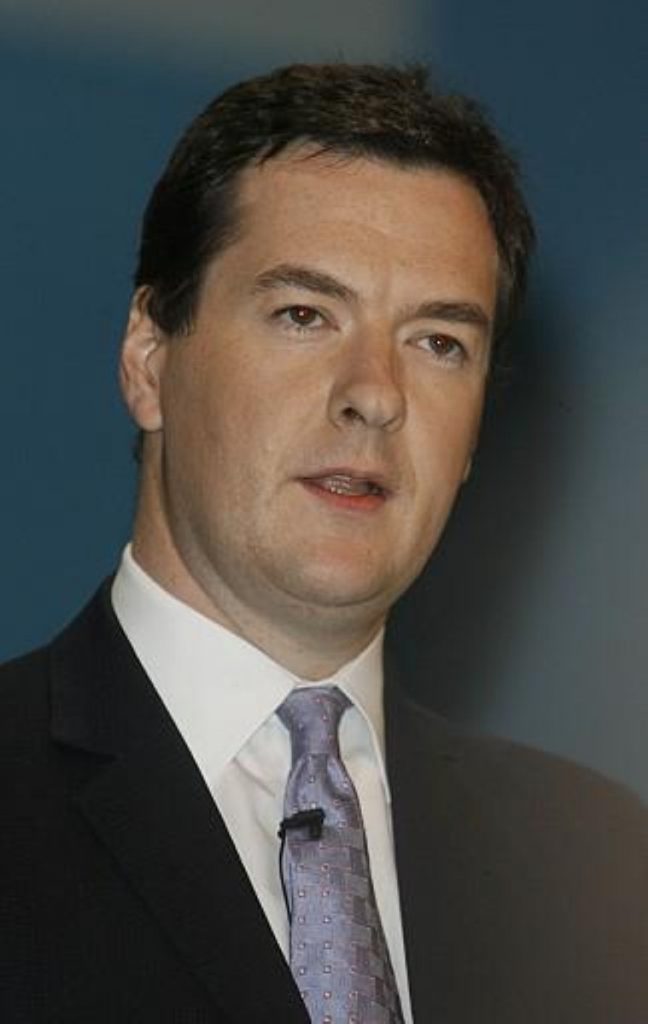

Shadow chancellor George Osborne said the tax would put a charge on the emissions produced by individual firms and would be a better system than the existing climate change levy, which is imposed on energy supplies to industry.

But in a speech to the Confederation of British Industry (CBI) annual conference, he stressed that any extra revenues raised by this new carbon levy would be offset by cuts in other business taxes – they would be revenue neutral.

His comments come after a new survey finds that seven out of ten business leaders in the FTSE 350 believe Britain is a poorer location for international business than it was five years ago.

The Ipsos/Mori poll carried out for the CBI finds 71 per cent want a cut in corporation tax, 85 per cent want a reduction in the cost of red tape and 95 per cent want a simplification of the tax system.

The Tories have promised to make the tax system simpler, and a recent report from the party’s economic policy commission proposed a lower rater of corporation tax.

However, Mr Osborne has stressed that stability will come before any tax cuts, and he emphasised this today, saying the proceeds of a strong economy would be split between cuts and public spending.

He also defended his party’s new focus on the environment, saying: “For too long my party abandoned issues like the environment, flexible working, and social responsibility to our opponents on the left.

“So I make absolutely no apology that we have been talking about the new business agenda. We are not just engaged in this debate – I believe we are helping to lead it.”

But the Tories are in danger of alienating business leaders – their traditional allies – with this ‘new agenda’ and their address to today’s CBI conference began on a difficult footing when leader David Cameron had to pull out at the last minute.

He has gone to Iraq to see for himself the current situation, and Mr Osborne explained to business leaders it was important for him to do that before the Baker commission into the strategy in the country published their findings.

Although CBI president John Sunderland said he respected Mr Cameron’s decision, he said the confederation was “disappointed” he would not be speaking.

“It would have given him a chance to address some of the uncertainties about his position on a number of important business issues, so we see this as a missed opportunity,” he said.

Launching a consultation paper on the new carbon levy, Mr Osborne noted that most business leaders questioned in the CBI survey felt taxes on labour and profits were the most damaging, and green taxes the least damaging.

He accused chancellor Gordon Brown of increasing national insurance and cutting the proportion of green taxes, saying: “We want to go in the opposite direction.

“We want to shift the tax burden away from income and investment and onto pollution. Pay as you burn not pay as you earn.”