Barclays boss admits cards ‘too expensive’

The chief executive of Barclays Bank has admitted that he would not borrow on credit cards because they are too expensive.

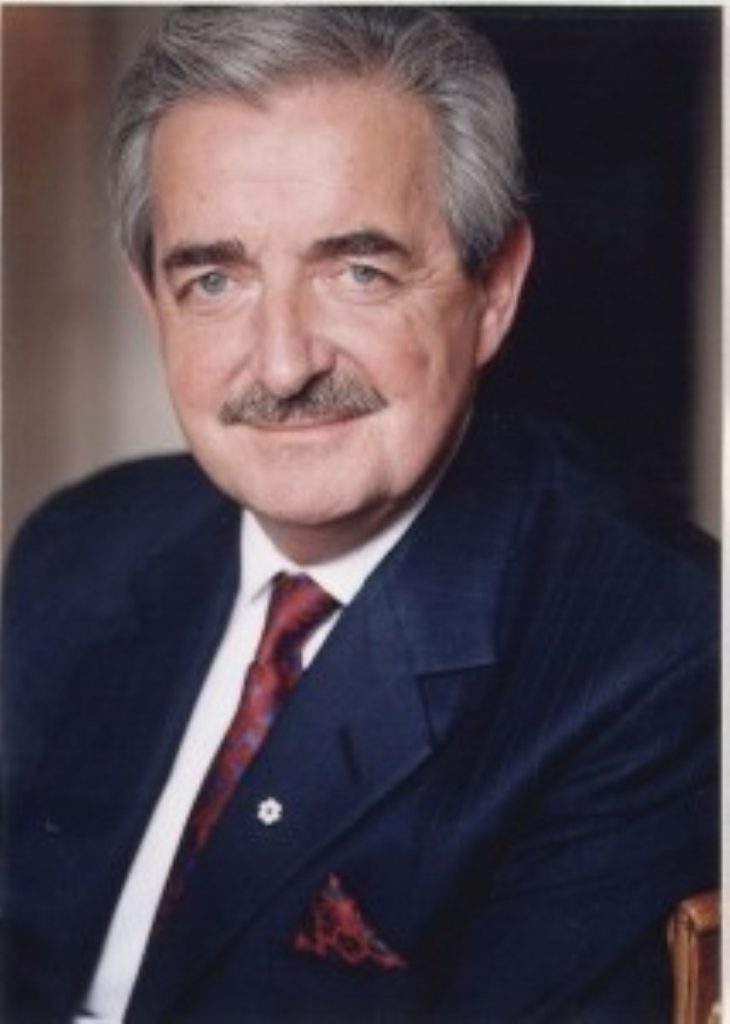

Speaking at a meeting between five major banks and the Treasury select Committee, Matthew Barrett also admitted that he advised his children not to pile up debt on a credit card.

Barclays was criticised by the Committee for charging 17.9 per cent interest on its credit card when national interest rates sit at a 48-year low of 3.5 per cent.

Interest charged on a Barclaycard has come down from 24.6 per cent to 17.9 per cent.

Asked whether he considered the rate of interest excessive, Mr Barrett suggested that he would “go elsewhere” for credit rather than use a credit card charging high interest.

Labour MP George Mudie asked him if this meant he had a rival Cahoot card, which charged interest at just eight per cent.

The committee, which was investigating the transparency of credit card charges, also heard evidence from the chief executives of Lloyds TSB, Royal Bank of Scotland, HBOS and MBNA European Bank.

The committee also criticised the banks for marketing their credit cards via junk mail.

Bosses agreed to make credit details clearer for customers and avoid confusing small print, from next year.