In December, Zog Energy became the 5th UK energy firm to fold in just three months.

During 2021 half of Britain’s energy suppliers went bust as gas prices soared by 250%, while just this week gas prices jumped by 30% across Europe as supply from Russia slumped.

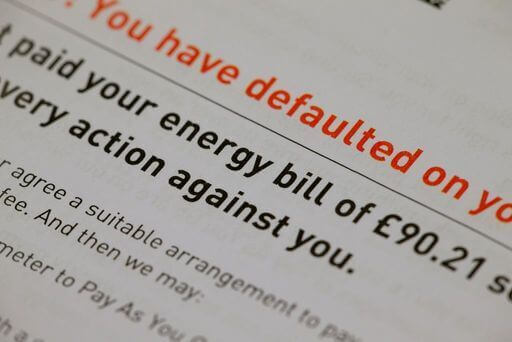

The UK’s cap on energy prices currently limits how much firms can charge consumers, which means that wholesale energy cost surges have so far mostly fallen on suppliers and led to so many of them collapsing.

However, when the cap is subject to its bi-annual review on 7 February, experts forecast that it will be permitted to rise by an additional £400 at the very least, with the increased prices coming into force from April.

But what is prompting these dramatic price hikes? And what, if anything, can be done to slow them or at least mitigate their impact?

Why are prices rising?

While it is easy to lay the blame for soaring energy costs at the government’s door, wholesale gas prices are an international problem.

A cold winter in 2020 left Europe’s natural gas stocks lower than usual, and a less windy summer in 2021 meant reduced generation from renewables.

Increased demand across Asia, as many industries rebound from the height of the pandemic, has also exacerbated the impact of reduced supplies. In authoritarian Kazakhstan violent protests erupted this week after petrol costs skyrocketed when price caps were lifted on liquefied petroleum gas. In Poland coal miners are mired in a dispute over pay as they are made to work longer hours.

EU politicians have blamed lower-than-expected Russian gas supplies on attempts by the Kremlin to exert pressure as it awaits regulatory approval for the Nord Stream 2 pipeline. If approved, the landmark project would double Russia’s capacity to export gas to Germany.

However, political mismanagement has played a role in the UK’s particular woes. Firstly, the UK is heavily reliant on gas, about half of which is imported. Around half of the UK’s power is generated by gas-fired power plants. Last year a string of factors, including unplanned maintenance outages and the fire damage of a major power cable used to import electricity from France, increased the UK’s dependence on these plants.

Despite the UK’s heavy reliance on gas for power, not to mention cooking and home heating, recent governments have run down the country’s gas storage capability. Less than 1% of Europe’s stored gas is currently held by the UK, much lower than in previous years and far behind our neighbours.

The impact of soaring prices

Fuel poverty is usually defined as a household that needs to spend over 10% of its income on energy costs. Scotland, Wales and Northern Ireland still generally use this definition. A 2013 paper produced by the now defunct Department for Energy and Climate Change redefined the category for England as households whose fuel costs are above the national median level, and who would be left with residual incomes below the national poverty line after paying their fuel bills.

The charity National Energy Action warned this week that from April at least 2 million more homes could slip into fuel poverty compared with spring 2021, meaning a record 6 million households would be categorised as such. Their analysis took into account the multiple definitions of fuel poverty across the UK.

There is also concern that alongside soaring energy costs, the UK is facing other cost of living pressures. The cost of living—the amount a person needs to spend to cover basic expenses such as housing, food and taxes—soared 5.1% in the 12 months leading up to November 2021, up from 4.2% in October, and the highest hike since September 2011.

This comes as a 1.25% hike in national insurance contributions is set to be rolled out from April. Meanwhile, the Treasury plans to freeze income tax thresholds until 2026 and most local authorities plan to increase council tax.

Jack Leslie, senior economist at progressive think tank the Resolution Foundation explained: “Fuel price inflation is at its highest level on record, going back to 1989, with prices rising 28.5% on a year earlier. And with factory gate inflation still rising, inflationary pressures will continue to build in early 2022, while pay packets continue to shrink.”

Analysis from the foundation also calculates that, alongside wage growth stalling last year, “real” wages would likely decline throughout most of 2022 and by 2025, real wages would be £740 below forecasts for pre-pandemic pay growth.

The energy crisis is also having a knock on effect on other supply chains as energy intensive industries, from chemicals and mining to the food sector, are curtailing operations as they suffer from poor profit margins. This could result in dangers to food security in import-reliant economies as crop yields slump due to reduced supplies of fertilizers.

The energy secretary proposed measures to support these industries in mid-October, but they have so far failed to materialise, with industry bosses warning that the government seems unwilling to act until it is too late.

Potential Solutions

Cutting VAT

Conservative MP and ex-minister, Robert Halfon, this week demanded “urgent action” from the government over the energy crisis. The MP for Harrow expressed his concern that “ordinary folk are set to be £1,200 worse off” over the coming year in a column for the Sun newspaper.

His remarks came after 20 Conservative MPs and peers demanded, in a letter to the Sunday Telegraph, that the government slash the 5% VAT on energy bills. They also pointed to the prime minister’s previous promise that Brexit would allow the UK to reduce energy bills.

Labour also backed this move last month, with shadow chancellor Rachel Reeves complaining that the government “blame global problems while they trap us in a high tax, low growth cycle.”

During a press conference on Tuesday the prime minister appeared to dismiss calls to pursue a VAT scrap, arguing that it would assist “a lot of people who perhaps don’t need the support” with rising living costs.

Allies close to the chancellor Rishi Sunak claim the cut has not been ruled out, but that his attitude of reluctance is based on the same arguments as the PM and that it would slice £2 billion from tax revenues.

Scrapping the green levy

Removing the green levy that currently adds around 25% to most people’s energy bills, would certainly slash costs but would be hard to stomach for the government’s net zero agenda.

Sunday’s letter from 20 Conservative MPs and peers also urged the government to remove the green levy to reduce pressures on consumers as prices rise. Former MP and Conservative Home editor Paul Goodman has suggested that the green levy should not be scrapped, but the income “recycled” to those on low incomes.

Loans and bailouts

While business secretary Kwasi Kwarteng has previously expressed reluctance to bail out energy firms, that his department set aside a £1.7 billion loan to prevent the collapse of Bulb energy in November could be a sign of similar measures to come. Huge taxpayer-funded bailouts are unlikely to go down well, however, and Kwarteng has repeatedly signalled his aversion to them.

Expanding the ‘Winter Homes Discount’

In this Tuesday’s inaugural cabinet meeting of 2021, ministers reportedly agreed that “something needs to be done” before 1 April, which will coincide with the hike in national insurance contributions.

Reports by the BBC have suggested that expanding eligibility for the winter homes discount that offers a one-off £140 payment is “under discussion”.

Removing the price cap

Free market think tank the Institute of Economic Affairs has called for the total scrapping of the energy price cap. Their energy analyst Andy Mayer said in December that “the government needs to stop tinkering at our expense”.

He added that removing the “artificial” cap on prices was required to “fix the source of the problem… and open the spigots to domestic fracking and storage tomorrow.”

The government has said keeping the cap in place is “non negotiable” however, and any attempt to make consumers bear the total brunt of soaring prices would likely prove to be politically unpalatable.

Whatever action is taken in the coming weeks, the issue of rising gas prices is not going away anytime soon, and it is likely that both consumers and energy firms will have to stomach increasingly bigger bills from April with no long-term plans to overhaul the energy market yet in sight.