Lib Dems warn of massive consumer debt

The Liberal Democrats have today claimed that Britons’ personal debt totals one trillion pounds.

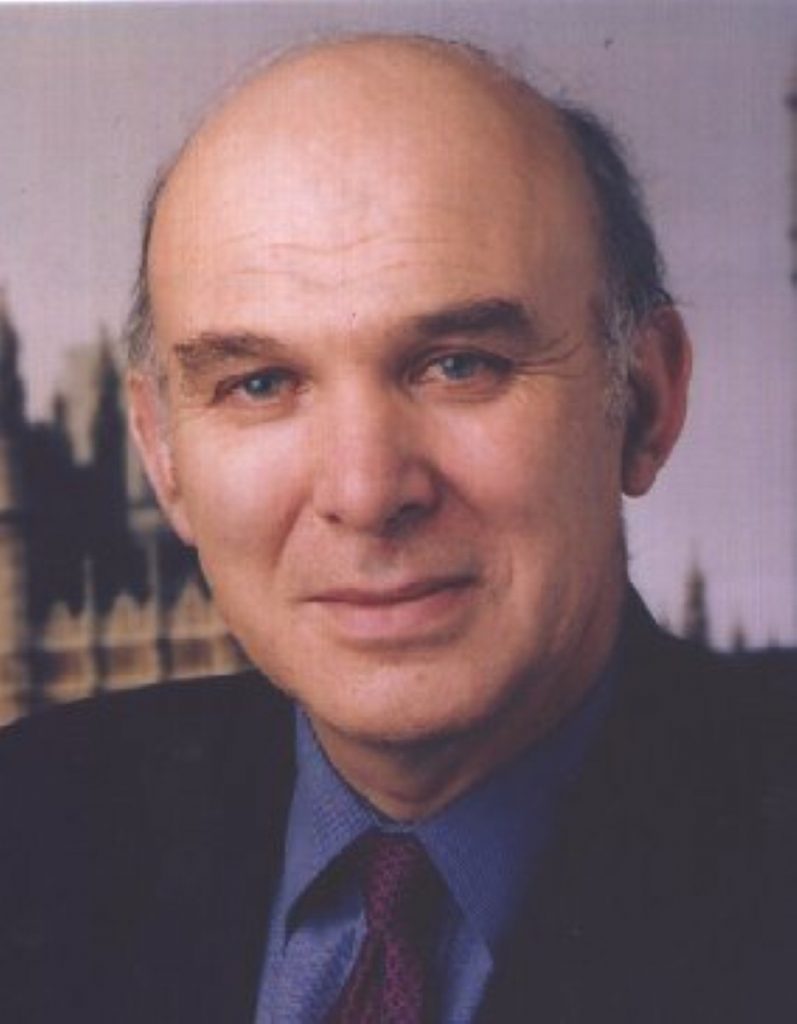

According to their Treasury spokesman, Dr Vince Cable, the amount owed by individuals and businesses is as much as the external combined debt of Africa, Asia and Latin America.

They also calculate that the interest payments required to service the debt, at an average APR of 7.5 per cent amounts to £6 billion a month.

Dr Cable accused Gordon Brown of having “fallen asleep while Prudence has gone off with another man.”

“Our borrow now, pay later culture has resulted in a new milestone for borrowing.”

Calling on the Chancellor to act, Dr Cable said: “Our proposals will result in a sustainable borrowing framework that protects consumers from unsustainable levels of personal debt, and protects the financial services industry from the damaging threat of a boom and bust economy.”

Among the Liberal Democrats’ proposals is a curb on the promotion of credit, a crackdown on loan sharks, and tighter policing and guidance of consumer credit interest rates.

Conservative Shadow Chancellor Oliver Letwin agreed with Dr Cable’s analysis: “Mounting personal debt is causing severe problems for an increasing number of families.”

“This is not an issue that can be ignored, which is why the Conservatives have set up a commission chaired by Lord Griffiths to investigate all aspects of household debt.”

The Bank of England base rate currently stands at 4.75 per cent, having climbed from a low 3.5 per cent. Though there are now predictions of interest rates reaching the highs of the 1980s in some quarters, many economists believe that rates will peak at around five per cent by the end of the year.