Chancellor acts as Irish lure savers

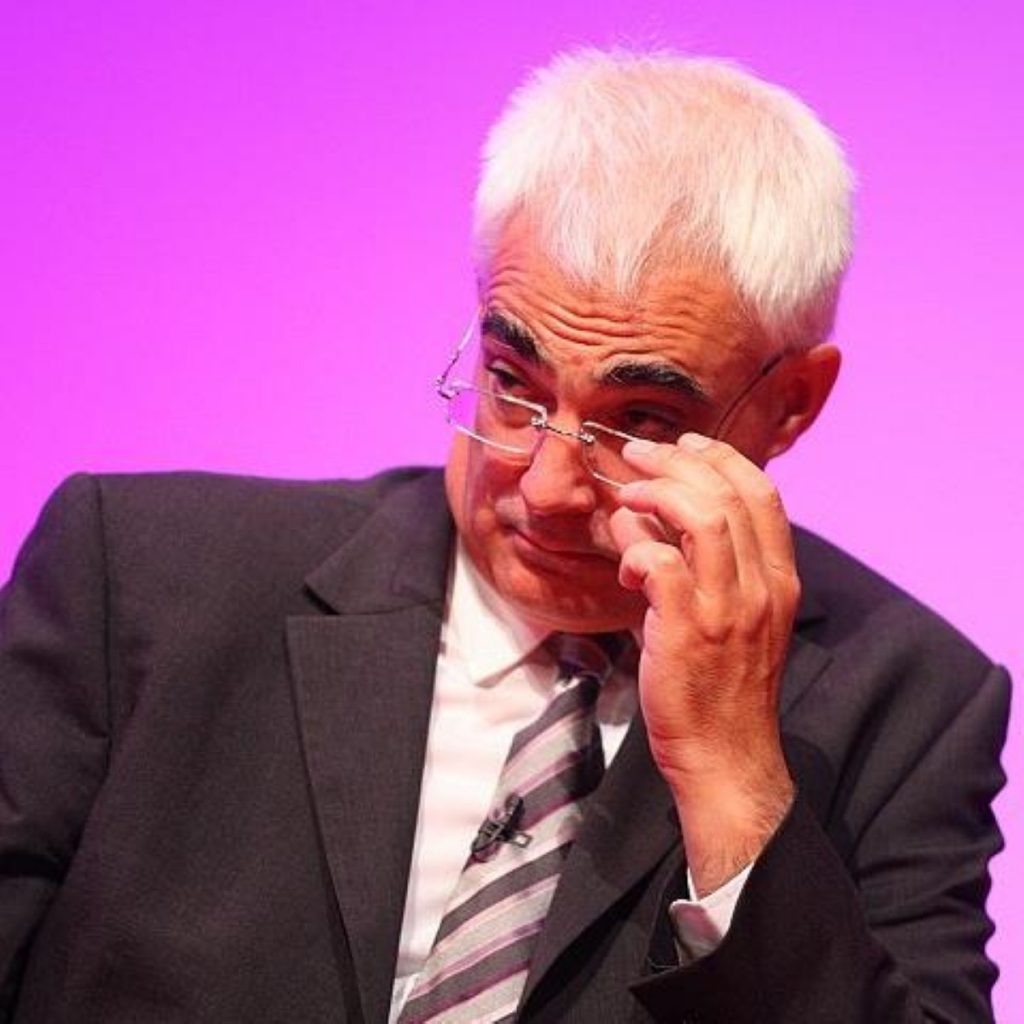

Alistair Darling spoke out against Ireland’s decision to guarantee 100 per cent of deposits as UK savers sought to protect their cash by looking across the Irish Sea.

Irish banks are similarly stretched to their UK counterparts – having lent heavily in the housing boom – and the Irish government hopes the guarantee will stop a domino effect of bank failures if just one went down.

Its move has sparked higher levels of interest from customers as fears within Whitehall grew that money held in British banks might be heading overseas.

The Irish banking move has led to complaints from the UK government the protection could distort the UK market and, as the Guardian newspaper reported, Mr Darling twice spoke with the Irish government yesterday.

The Irish Ministry of Finance confirms Alistair Darling has been in contact with his Irish counterpart Brian Lenihan to discuss the plans.

The UK Treasury refused to disclose the exact details of the discussion, but a spokesperson confirmed they discussed recent developments.

The Irish plans initially cover the country’s six largest banks – including Allied Irish Bank, Bank of Ireland, Anglo Irish Bank – but the ministry has confirmed subsidiaries of non-Irish banks can apply for protection.

The legislation also covers wholly-owned Irish subsidiaries in the UK such as those of Allied Irish Bank, Bank of Ireland and Anglo Irish Bank.

The British Bankers’ Association (BBA) has also written to Mr Lenihan to complain about the move – stating it is distorting the market.

A BBA spokesperson said: “While we sympathise with the move but the Irish government, it is anti-competitive.”

The BBA could not confirm reports cash was heading into Irish banks; however, the body does report more banks accounts are being opened.

“What this means is the same number of people are opening more accounts so people are spreading their risk. It is a prudent move when people want to protect their families and money.”

Under current UK laws the first £35,000 of under savings are protected under the Financial Services Compensation Scheme (FSCS) – although Gordon Brown has suggested this could rise to £50,000.