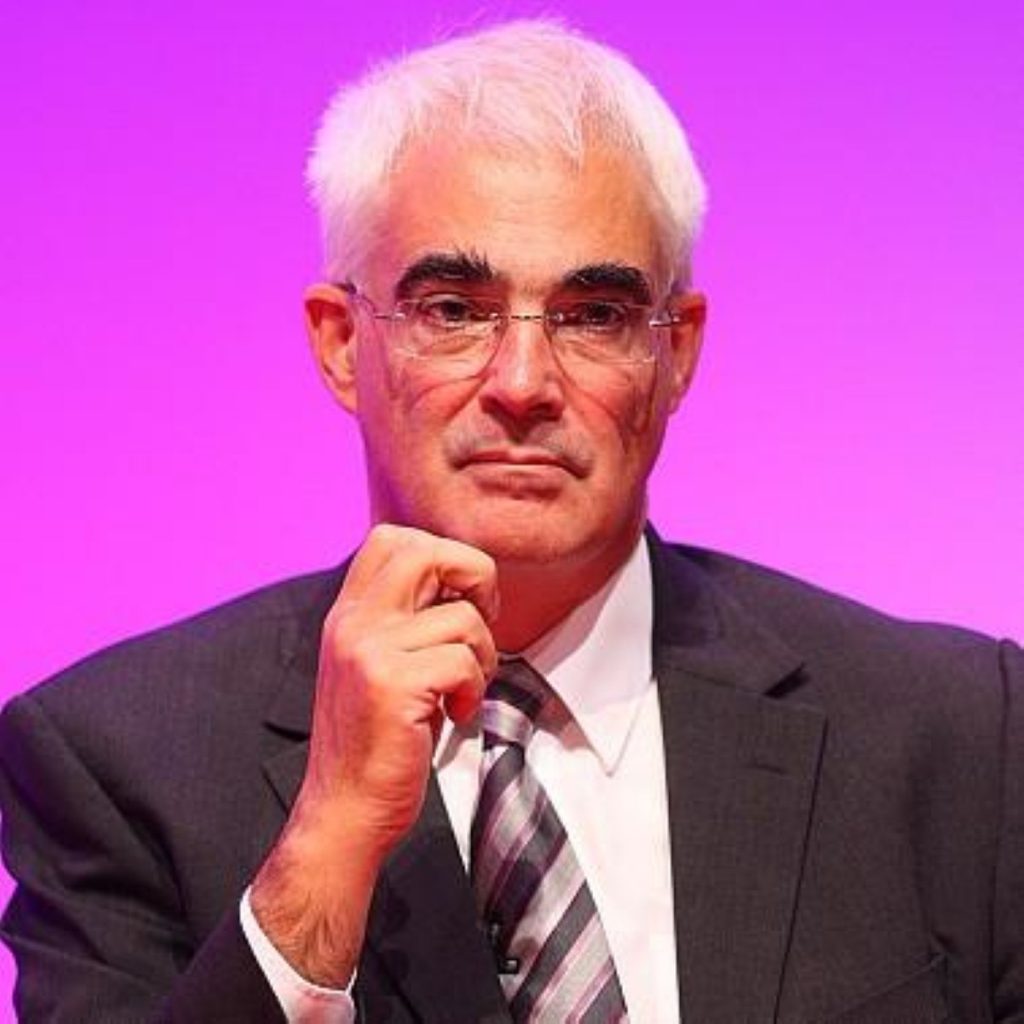

Darling props up banks with £50bn

Alistair Darling has confirmed the government is to provide a £200 billion liquidity fund for UK banks and a further £50 billion investment into invididual banks themselves.

The £50 billion investment is expected to be used to shore up LLoyds TSB, Barclays and Royal Bank of Scotland.

Speaking to TV-AM, the chancellor said he was also prepared to stand behind those savers that were fearing that had lost everything as a result of the collapse of Iceland’s second largest bank yesterday, Landsbanki, which operated the internet bank Icesave.

Mr Darling said the government would be “pursuing the Iceland government which has defaulted on obligations but I intend to stand behind those who saved with Icesave and I will say more about that in the House of Commons later today.”

Meanwhile Mr Darling outlined three courses of action the government would be taking to shore up the banking system.

The government is making £200 billion available to provder liquidity to the money markets – effectively pumping money in the money markets to restore confidence and try to encourage the banks to begin to lend to one another again.

The government is also providing £25 billion immediately which it is investing in the eight biggest banks in the UK for which it will receive shares.

And finally the government is to guarantee all loans that banks make to each other – again in order to restore confidence in the bnanking system.

Yesterday Mr Darling joined the governor of the bank of England and the head of the Financial Services Authority in holding talks with the prime minister at No 10.

The chancellor provided few concrete details of the plan when he spoke to journalists after leaving the talks with Gordon Brown, Mervyn King and Lord Turner. But the talks went on throughout the night and are only thought to have broken up at 05:00 BST.

It is being reported that as part of the deal, the government has also demanded a boardroom shake-up at Royal Bank of Scotland (RBS), one of the most troubled banks. Sir Fred Goodwin, the bank’s chief executive, and Sir Tom McKillop, the chairman are expected to leave.

Meanwhile the prime minister will say later that “extraordinary times call for bold and far reaching solutions”.

“This is not a time for conventional thinking or outdated dogma but for fresh and innovative intervention that gets to the heart of the problem.

“These decisions on stability and restructuring are the necessary building blocks to allow banks to return to their basic function of providing cash and investment for families and businesses.”

Alistair Darling is due to make a statement before the London Stock Exchange opens on Wednesday morning, ahead of an address in the House of Commons later in the day.

“The Bank of England has been putting substantial sums into the markets today and is ready to do more when that’s needed,” he said.

“As I said in the House of Commons on Monday, we’ve been working closely with the governor of the Bank of England, with the Financial Services Authority and financial institutions to put the banks on a longer-term sound footing.

“I intend to make a statement before the markets open tomorrow morning and I will be making a further statement to the House of Commons later in the day.”

The Downing Street talks were held in reaction to a second day of panic on the FTSE 100, particularly on banking stocks.

Royal Bank of Scotland lost 39 per cent of its value in another turbulent day, while Barclays and Lloyds TSB fell nine per cent and 13 per cent respectively.

This followed Monday’s unprecedented falls on the FTSE 100, which slumped to its worst daily decline for more than two decades.

The Nikkei 225 also fell nine per cent last night – its biggest one day fall since 1987 – as a result of fears of a banking collapse.