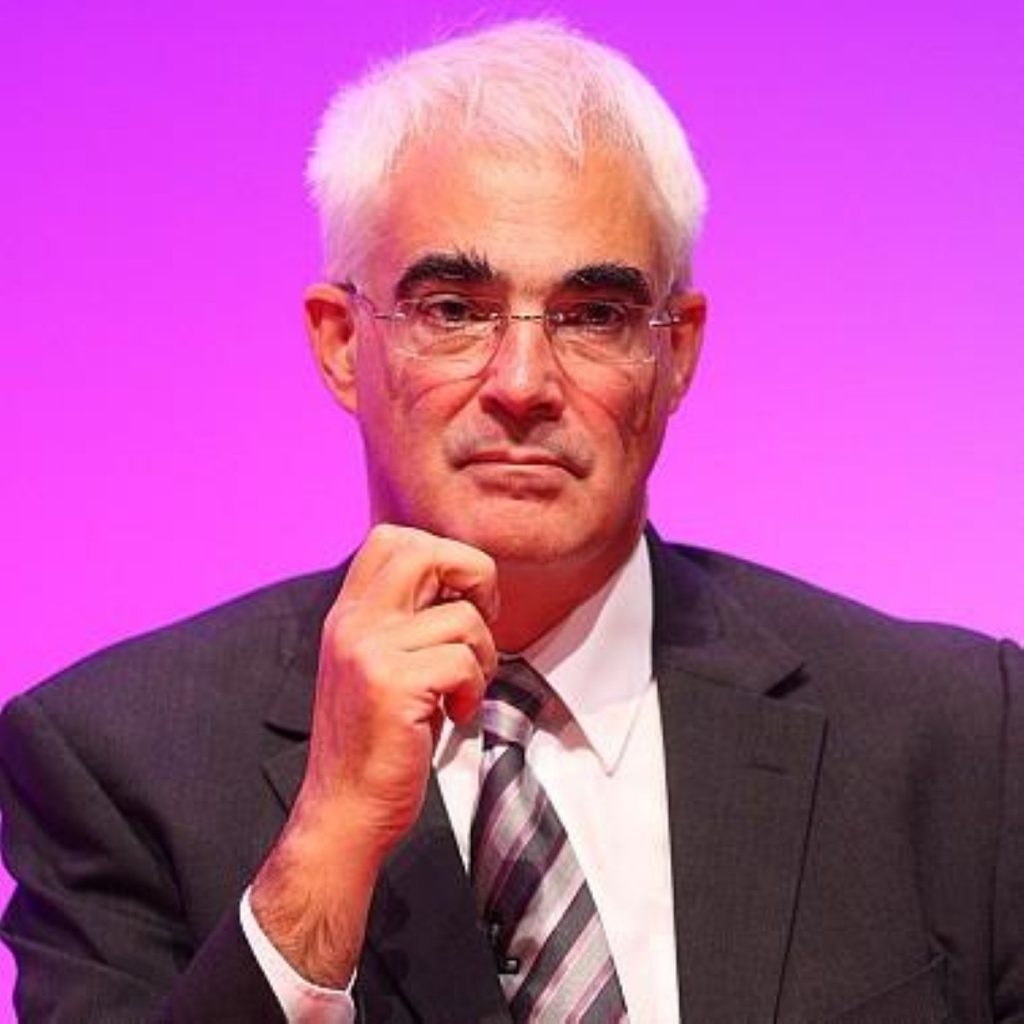

Darling slashes RBS bonuses

By politics.co.uk staff

Alistair Darling has announced the Royal Bank of Scotland (RBS) will cut its bonuses.

The amount paid out in bonuses will fall from the £2.5 billion paid last year to £175 million.

Mr Darling explained staff on the ground in branches would maintain their bonuses.

He told the BBC RBS bonus payments would be “the minimum it can with regard to its legal obligations”.

No cash bonuses will be paid in 2009 for performance in 2008, RBS announced, with only legally guaranteed bonuses paid.

Bonuses to staff will also be deferred – and could be taken away if performance in 2008 leads to further losses down the line.

Liberal Democrat economics spokesman Vince Cable welcomed the move.

“After weeks of political and public pressure, it is welcome if long-overdue news that RBS has at last come out with what seems to be an acceptable pay agreement,” he said.

Shadow chancellor George Osborne said: “The government has finally been dragged into acting on bonuses but once again it is too little too late.

“David Cameron said at the weekend that all cash bonuses over £2,000 should be stopped in the banks that have been bailed out. If need be, the government should be prepared to defend that decision in court.”

Sir Philip Hampton, RBS Group chairman, said: “A fundamental reform to pay and reward is needed to reflect the reality of the situation the company is in.

“This approach also means that we now can offer some certainty to our employees to enable them to plan ahead financially.

“Our staff have had to contend with significant anxiety over recent weeks and months over a situation that the vast majority bore no responsibility for creating.”

He added the bank had tried to focus the worst impact of the changes on more senior staff and those in areas responsible for the major losses recorded in 2008.

Board members will receive no bonus for 2008 and no pay increase in 2009.

Mr Darling told Sky News: “I think it is important that we end the short-term bonus culture.

“People are understandably angry at the mismanagement at the top of some of these banks.

“What should be rewarded is hard work and building up long-term strengths of these banks.”

In total the government has put £20 billion into RBS and now holds a 68 per cent stake in the firm.

Mr Darling explained staff on the ground in branches would maintain their bonuses.

Under the RBS plans, the Profit Share ‘bonus’ scheme worth ten per cent of salary – and paid to those on average with a salary of £18,979 – will not be paid for 2008, and will be terminated for all future years.

An equivalent payment will be made as part of the existing monthly award package to staff below managerial grade, beginning in 2009.