Cable: Split up the banks

By Alex Stevenson

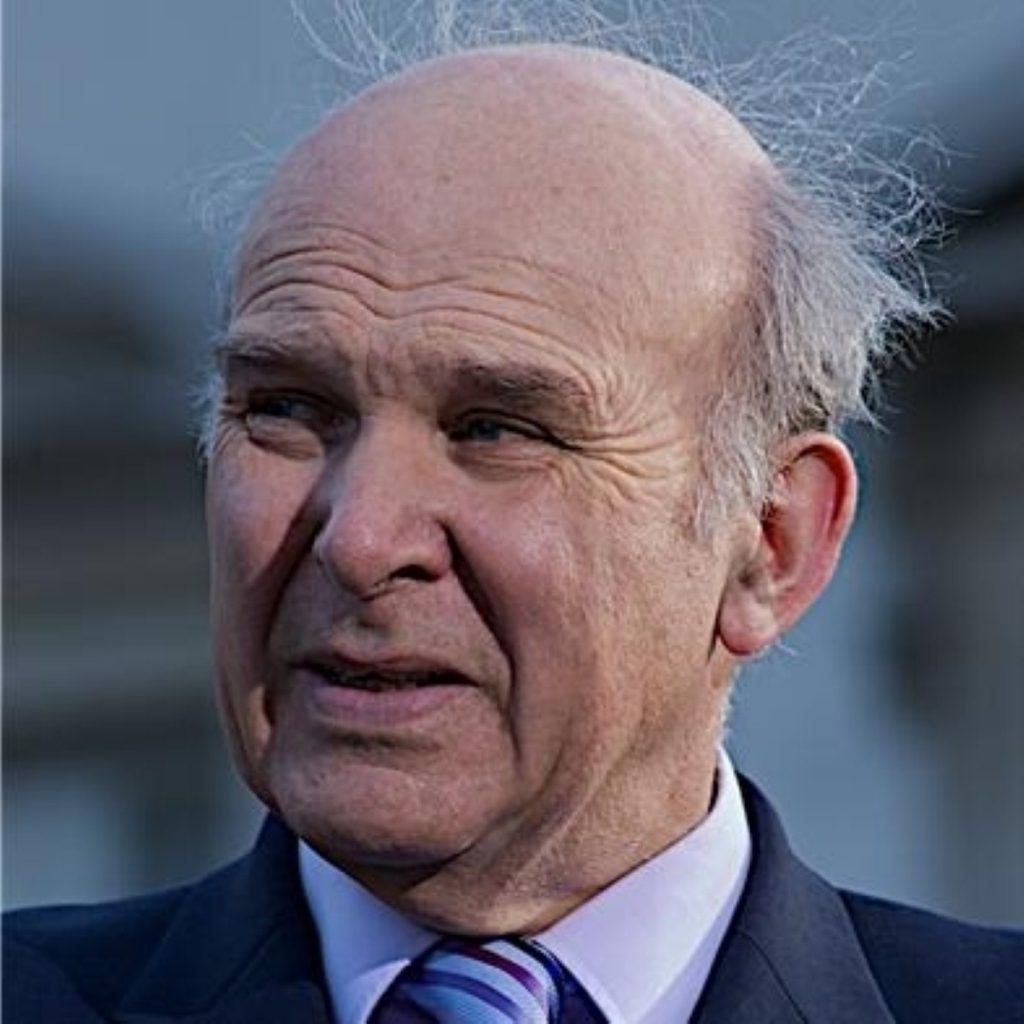

Britain’s semi-nationalised banks will have to be split, Liberal Democrat Treasury spokesman Vince Cable has said.

Speaking as he launched his party’s proposals for banking regulation, Dr Cable said the break-up would have to be forced through to prevent a further financial crisis.

“The problem remains that size matters,” he told an audience at the London Stock Exchange.

“The banks are going to have to be split. It shouldn’t happen overnight, in a depressed environment, but it’s going to have to happen.”

Dr Cable said the City was already drifting towards splits. He said RBS was contemplating divestment of some assets, while many of the biggest mortgage lenders would soon be forced to split for competition reasons.

His comments reflected a wider preparedness to use the nationalised banks more actively. The Liberal Democrats would encourage more lending to solvent banks, for example.

Dr Cable also said while his party remained committed to a temporary nationalisation an issue about “timing” remained, however.

“All the experience of other countries. suggests that banks may have to remain under public ownership for as much as a decade,” he added.

Dr Cable explains the thinking behind his proposals:

Dr Cable was dismissive of the Labour and Conservative dispute over the tripartite system, comparing their respective support for the Financial Services Authority and Bank of England to schoolboy behaviour.

“It’s foolish and it’s damaging,” he said, describing the spat as “something of a diversion” resembling a “playground punch-up”.

The Lib Dem economic affairs guru took a hard line against his City audience on the matter of bankers’ bonuses, explaining to them public sensitivity arose from the taxpayers’ involvement.

“Without the taxpayer, many bankers would be without a job let alone the huge bonuses they are enjoying,” he said, proposing that remuneration policy of regulated financial institutions should be approved by the FSA.