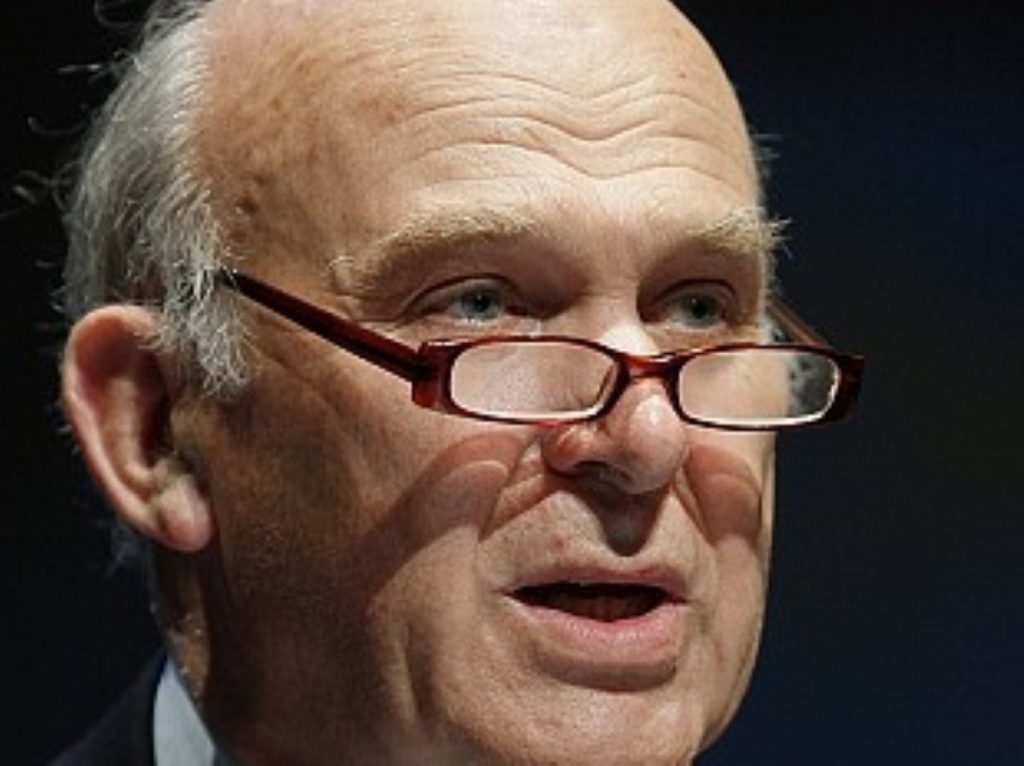

Cable: Business needs me to bash the banks

By Ian Dunt

Business needs a tough government minister willing to ‘bash the banks’, Vince Cable has said.

The business secretary told the Confederation of British Industry’s (CBI) annual conference that his robust rhetoric against capitalism and the banking sector is designed to save the free market from itself.

“We are still cleaning up after the massive damage caused by the near collapse of the banking system,” Dr Cable told the audience of business leaders.

Commenting on concerns about his rhetoric from some quarters of the business community, Dr Cable added: “Businesses – including a lot of CBI members – keep telling me that I am perhaps not bashing them [the banks] enough.

“Of course, there is no point in engaging in a sterile public exchange of insults. But no one listening to the chancellor’s statement last week will be under any doubt of the government’s collective determination to ensure that banks act in the interests of the wider economy – and that in the new year they don’t engage in another self-indulgent bonus round.”

The business secretary insisted that banks needed to face up to the reality of reform to avoid a repeat of the financial crisis.

“For those who say that by crimping the banks’ style, by stopping them indulging in short term speculation, that we are somehow damaging their shareholders’ interests, I want to know: how did short termism work out for you?” he asked.

“A glance at the share price graphs around 2008 suggests ‘not very well’.

“We must not make the mistake of putting off reform. Growth cannot copy the past – with a superficial economic prosperity based on booming property markets.”

Dr Cable also announced a consultation on firming up Britain’s regulatory system for competition, in which the Competition Commission and the competition functions of the Office of Fair Trading will be brought together to form a single competition authority.

The business secretary wants more competition investigations taking place and a more proactive approach from the relevant authorities.

“Competition Act cases have taken on average three-and-a-half years between the investigation to a final decision. This is too slow – hardly the ‘efficient and timely processes’ that the CBI has called for,” he is expected to say.

Takeovers could face additional scrutiny as well, with Dr Cable suggesting that mergers require an official pre-notification so that competition authorities can properly investigate repercussions.

A review on corporate governance and short-termism begun today will assess whether boards understand the long-term implications of takeovers, the implications of the changing nature of UK share ownership and whether disclosure of directors’ pay should be more transparent.