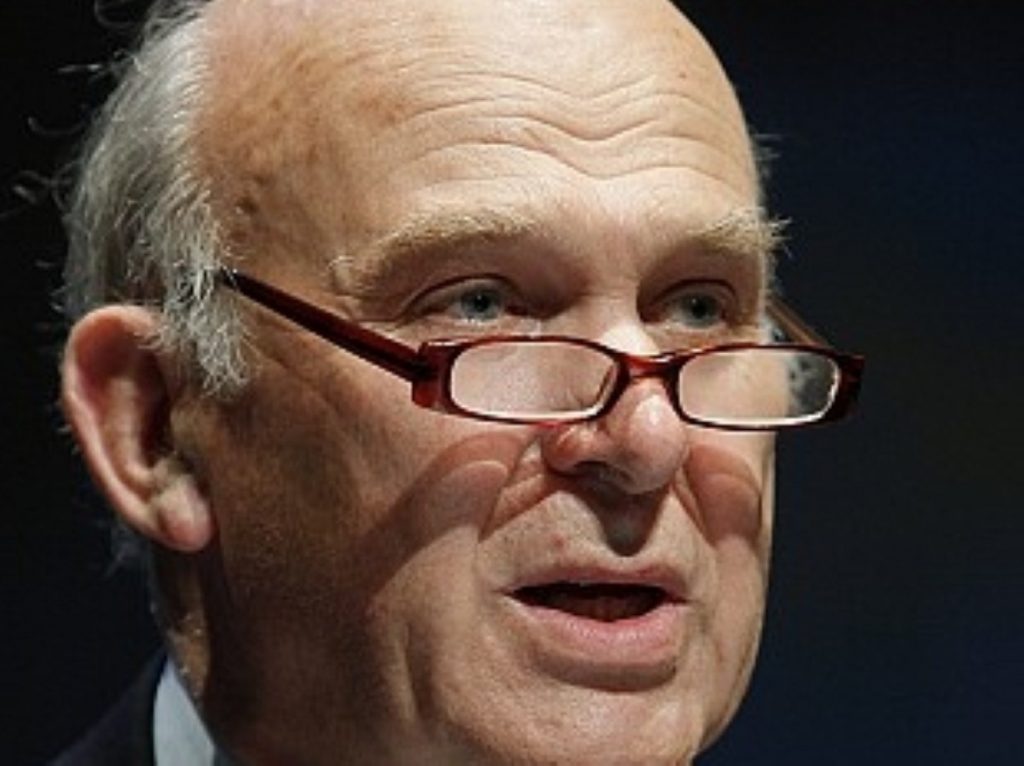

Vince Cable ‘appalling inequality’ speech in full

Read Vince Cable's 2011 conference speech, in which he attacks "appalling inequality", in full on politics.co.uk.

These are dangerous times for our economy.

There is much uncertainty.

But I am absolutely certain that, at such a moment, the country is stronger for having two parties in coalition working in the national interest.

When I joined up I had very mixed feelings about this coalition, like many of you.

I looked for good precedents.

I thought of Attlee and Bevin working with their Tory opponents – Churchill and Beaverbrook – setting aside their political differences in a common cause.

That coalition unleashed the great Liberal reformers; Beveridge and Keynes.

Now, you could say: that was war; that’s different.

Yes, it is different.

But we now face a crisis that is the economic equivalent of war.

This is not a time for business as usual; or politics as usual.

The financial crisis is still with us.

It never went away.

And we can see that recovery has stalled in the US and the position in the Eurozone is dire.

But it is wishful thinking to imagine that we have a healthy economy being infected by a dangerous foreign virus.

Many of our problems are home-grown.

Gordon Brown regularly advised the rest of the world to follow his British model of growth.

But the model was flawed.

It led to the highest level of household debt in relation to income in the world.

It produced a dangerously inflated property bubble.

It encouraged a bloated, banking sector while manufacturing declined at an unprecedented rate.

Then, they socialised the costs of the crash though a massive budget deficit, the biggest of any major economy.

His disciple, Ed Balls, has – sort of – apologised but advocates policies that would repeat the disaster.

What this period of crisis should have taught us, above all, is humility.

And humility in politics means accepting that one party doesn’t have all the answers; recognising that working in partnership is progress not treachery.

It has been hard.

It has required courage from our Party to withstand the tribalism which is British politics at its worst.

And it has not been possible for the Party to get its own way on everything.

I regret this year is that we did not secure tighter control on bank pay and bonuses.

A bad message was sent: that unrestrained greed is acceptable.

We now know where that leads.

But we have real achievements.

My team in the Business Department (and I want to acknowledge David Willetts and Ed Davey’s role in particular) has not only made a major contribution to deficit reduction but is now helping recovery.

We have greatly expanded apprenticeships.

Giving respect and recognition to the 60% of young people who do not pursue academic study in universities.

We protected our science budget and we have launched a chain of Technology Innovation Centres promoting the technologies of the future.

We have established a Green Investment Bank to benefit major green projects.

Nick Clegg has driven our Regional Growth Fund, investing in businesses and jobs up and down the country not just the South East

We, and Ed in particular, have done what Conservative and Labour governments failed to do: legislate for a necessary reform of the Royal Mail with worker shares and provide a stable future for the Post Office Network.

And then – after a generation of manufacturing decline we have brought jobs back to Britain in steel at Redcar; in motor vehicle supply chains and electric vehicles; and in aerospace through Rolls Royce Airbus and Augusta Westland.

This morning Jaguar Land Rover has announced that they are to build a new engine plant in the West Midlands – that is a massive boost for British manufacturing, and the region.

That’s what I mean by a business recovery, cars not casinos.

The work is just beginning.

To turn Britain round we need much more.

Three priorities: Stability, stimulus, solidarity.

Stability in the government’s finances – the deficit problem – and in our banks.

Stimulus to support growth; sustainable growth based on business investment, exports, green technology and manufacturing.

Solidarity to give people a sense of a shared society, reducing our appalling inequalities of income and wealth, and creating a responsible capitalism.

STABILITY

As for stability, the last government promised an end to boom and bust but gave us both – and left us a dangerous, unsustainable budget deficit.

Cutting it is a thankless and unpopular task, but unavoidable if our country and party are to be taken seriously.

The Government’s tough approach to deficit reduction is often attacked as ideological, as right wing.

Financial discipline is not ideological; it is a necessary precondition for effective government.

I see us following in the footsteps of Stafford Cripps and Roy Jenkins in Britain and, abroad, the Canadian Liberals, Scandinavian Social Democrats and Clinton Democrats in the USA.

They understood, unlike today’s Labour Party – that the progressive agenda of centre left parties cannot be delivered by bankrupt Governments.

I think most of the British public do get it.

But there are politicians on both left and right who don’t.

Some of them believe government is Father Christmas.

They draw up lists of tax cuts and giveaways and assume that Santa will pop down the chimney and leave presents under the tree.

This is childish fantasy.

Some believe that if taxes on the wealthy are cut, new revenue will miraculously appear.

I think their reasoning is this: all those British billionaires who demonstrate their patriotism by hiding from the taxman in Monaco or some Caribbean bolt hole will rush back to pay more tax but at a lower rate.

Pull the other one!

Financial stability doesn’t just involve the Government budget.

Massive potential instability is caused by UK-based global banks whose combined assets are over 400% of GDP, by far the largest of any major country.

At present, banks are offered a one way bet.

If they gamble and win; they fill up the bonus pool.

But when they lose, the taxpayer pays.

The Independent Banking Commission provides a means to stop this dangerous nonsense.

The Commission’s key findings – to separate retail and casino banking – must be put in place.

Legislation will start soon and be completed in this parliament.

If there were any doubts about the need for radical reform the UBS rogue trader has dispelled them.

We simply cannot have rogue institutions exposing taxpayers to the risk of exploding financial weapons of mass destruction.

The banks must also perform their basic economic function of channeling our savings into productive investment.

They are not doing so.

Productive British business and banking are currently at odds.

Banks operate like a man who either wears his trousers round his chest, stifling breathing, as now, or round his ankles, exposing his assets.

We want their trousers tied round their middle: steady lending growth; particularly to productive British business, especially small scale enterprise.

No more feast and famine in bank lending.

STIMULUS

The big economic policy question now is how to progress from financial stability to growth.

With business and consumer confidence so low, there is a special responsibility on government.

We are not bystanders.

My job is to support businesses, that means promoting British commerce in the big emerging markets that have been neglected in the past.

It means keeping Britain open to inward investors, trade and skilled workers.

It means cutting red tape which is suffocating growing companies which create jobs.

What I will not do though is provide cover for ideological descendents of those who sent children up chimneys.

Panic in financial markets won’t be stopped by scrapping maternity rights.

But the immediate threat is lack of demand – with consumers, companies and governments cutting spending.

Keynes talked about a ‘paradox of thrift’; everyone and every country being individually wise but collectively foolish – leading to a downward spiral.

A lot of responsibility rests on the Bank of England to relax monetary policy further linked to small business lending.

But Government can act:

• Use Chris Huhne’s Green Deal to generate an estimated 100,000 jobs in energy conservation;

• Leverage in private investment through the Regional Growth Fund and the Green Investment Bank

• Adopt the Liberal Democrat policy to allow councils to auction land with planning permission using the proceeds for social housing;

• Step up investment in our clapped out infrastructure.

There are tens of billions of pounds of British savings in pension funds and insurance companies ready to invest in transport, energy.

Broadband and housing if regulators can ensure a reasonable, moderate return.

And as Danny announced yesterday the government is putting serious money behind local projects.

SOLIDARITY

Even with a stimulus to support recovery the next few years will be difficult.

Living standards are being squeezed by continued high imported inflation.

And the painful truth is that Britain is a poorer country as a result of the financial crash.

The public will only accept continuing austerity if it is seen to be fair.

Yet there is currently a great sense of grievance that workers and pensioners are paying the penalty for a crisis they did not create.

I want a real sense of solidarity.

That does not mean that we go round in blue boiler suits carrying little red books, though I suspect that some on the right believe that is my agenda.

It does mean a narrowing of inequalities.

We have, as a Party, made clear our priorities for continuing to lift low and average earners out of tax.

And the wealthy must pay their share.

What Liberal Democrats should focus on are the vast disparities in wealth – much of it in inflated property and land prices artificially generated by the boom of the last decade.

A few weeks ago a house changed hands for £140 million.

And one newspaper headline said, without irony, “Oligarchs priced out of central London.

Yet the owners of these mansions pay no more tax than many occupants of a family semi.

When some critics attack our Party policy of a tax on properties over

£2 million by saying it is an attack on ordinary middle class owners, you wonder what part of the solar system they live in.

Let me be clear, there is absolutely nothing wrong with generous rewards for those who build up successful businesses and create wealth and jobs.

People accept capitalism, but they want responsible capitalism.

As for irresponsible capitalism, some of you may have noticed that one of the big media companies has recently had a spot of bother.

(I think you know who I mean)

The Labour Party, the Conservatives and even the Scottish Nationalists spent years queuing up to pay them homage to them.

What makes me proud of our Party is that we never compromised ourselves in that company.

What I want to do is to strengthen the best of British business.

I have taken two initiatives in particular:

• I have asked Professor John Kay, together with Sir John Rose, formerly CEO of Rolls Royce – whose company embodies responsible capitalism in its commitment to long term investment in training and R&D – to look at how we get stock markets and institutional investors out of their short term, speculative mindset.

• I am separately consulting on how best to tackle the escalation of executive pay which, in many cases, has lost any connection with the value of shares, let alone average employee pay.

It is hard to explain why shareholders can vote to cut top pay but the managers can ignore the vote.

And surely pay should be transparent; not hidden from shareholders, and the public.

I want to call time on pay outs for failure.

CONCLUSION

Let me say in conclusion that when my staff saw my draft of this speech they said; we can see the grey skies where are the sunny uplands? I am sorry, I can only tell it as I see it.

People aren’t thinking about 10 years ahead when they are worrying about how to survive the next 10 days to payday.

But I do sense a deeper truth: that the public is tired of being lied to by politicians; promised what cannot be delivered.

The truth is that there are difficult times ahead, that Britain’s post war pattern of ever rising living standards has been broken by the financial collapse.

But we can turn the economy around.

In the Coalition Agreement we promised to put fairness at the heart of all we do as we rebuild our broken economy from the rubble.

Liberal Democrats know that you can’t do one without the other.