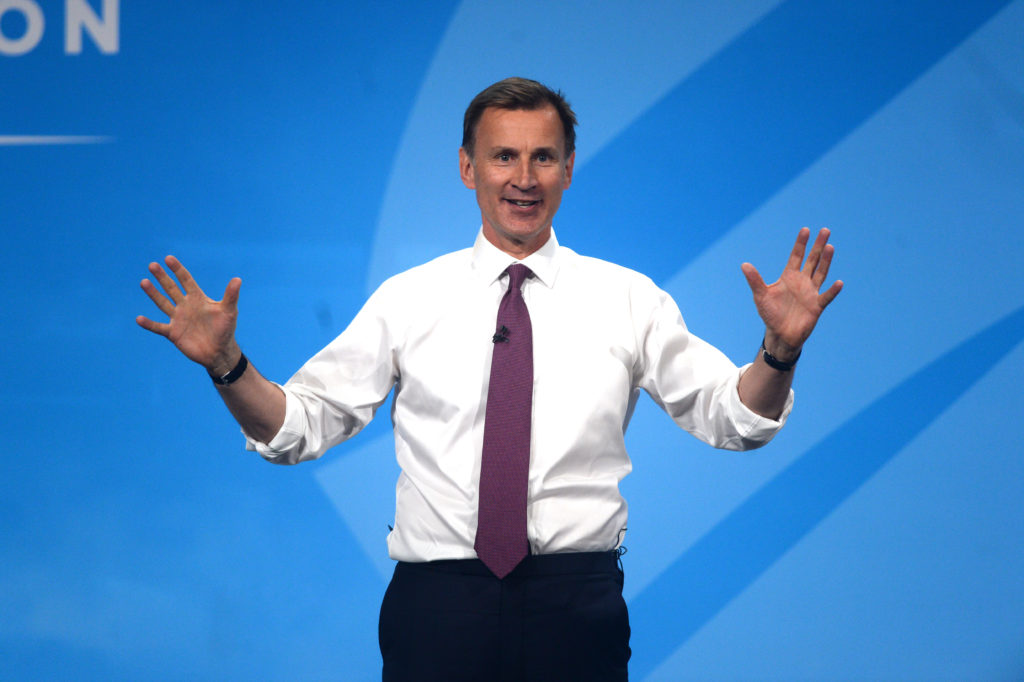

Jeremy Hunt’s announcement on Wednesday, due to be delivered to the House of Commons at 12.30pm, will be the UK’s first budget in well over a year.

The last budget was delivered by current prime minister Rishi Sunak in October 2021, three chancellors ago. Since then, British politics has been peppered with “fiscal event” after “fiscal event”, most memorably Kwasi Kwarteng’s “mini-budget” last September which preceded the fall of prime minister Liz Truss.

The current chancellor fronted his first fiscal event in November. The Autumn Statement proposed tax rises and future spending cuts in response to the market turmoil incited by the mini-budget.

Now Hunt, who spent the weekend facilitating the sale of Silicon Valley Bank’s UK arm to HSBC, will front his first official budget. The focus is expected to be on measures to tackle workforce shortages, enhancing support for childcare and energy costs.

Energy bill measures

The government’s Energy Price Guarantee (EPG), which caps energy costs for households, is due to rise from £2,500 to £3,000 on April 1.

It means that although energy prices are falling, households will see their energy bills spike by several hundred pounds when government support is tapered.

However, The Times has reported that the EPG will be continued for another three months as part of new proposals in the Spring Budget.

It comes as lower-than-expected borrowing has left room for the cap on gas and electricity costs to be extended.

However, a planned withdrawal of the £400 winter discount that went to every household is expected to go ahead.

Additionally, more than four million struggling households are also set to save £45 a year on energy bills from 1 July with upcoming changes to prepayment energy charges.

This will happen by bringing prepayment energy charges in line with customers who pay by direct debit.

Commenting on the pledge, the chancellor said it was “clearly unfair that those on prepayment meters pay more than others. We are going to put an end to that”.

Childcare

The Spring Budget looks set to increase the maximum amount parents in receipt of universal credit can claim for childcare.

The maximum universal credit childcare allowance has been frozen at £646 per month per child for years. This will now be lifted, although no figure has been given for the new cap.

The current cap means that if a universal credit claimant’s monthly childcare bills are over the cap, parents have to pay the rest of the amount

Hunt is thought to be considering a proposal by the Confederation of British Industry (CBI), which is urging the government to expand free childcare to all one and two year olds.

Public sector pay

There remains significant political pressure on the chancellor to increase public sector salaries for nurses, teachers, civil servants, rail workers and others as they continue to strike over pay rises that do not match the 10.1% rate of inflation.

However, at the moment, existing departmental budgets will allow for a 3.5pc public sector pay rise.

As things stand, the Treasury is resisting demands for more money to end the industrial action, although recent talks involving ministers and trade unions representing NHS staff suggest a pay deal could be close.

The Institute for Government has said that rejecting pay increases will “make it much harder for the government to address backlogs and other public service performance issues”.

Over-50 back to work schemes

One key priority for Hunt in the Spring Budget is likely to be incentivising the hundreds of thousands of over 50s who disappearing from the workforce to return.

Excluding students, there are 6.6 million working-aged adults who are classed as economically inactive. It is thought to be a major barrier to economic growth.

Speaking to Sky News ahead of his budget announcement, Hunt personally urged over-50s who have taken early retirement to go back to work. The chancellor billed his Spring budget as a back-to-work statement, adding that he would “break down the barriers that stop people here in the UK from working”.

He added: “For many people, there are barriers preventing them from moving into work — lack of skills, a disability or health condition, or having been out of the jobs market for an extended period of time.

“I want this back-to-work budget to break down these barriers and help people find jobs that are right for them.

“We need to plug the skills gaps and give people the qualifications, support and incentives they need to get into work. Through this plan, we can address labour shortages, bring down inflation, and put Britain back on a path to growth.”unt said: “For many people, there are barriers preventing them from moving into work — lack of skills, a disability or health condition, or having been out of the jobs market for an extended period of time.

“I want this back-to-work budget to break down these barriers and help people find jobs that are right for them”.

As part of new proposals, older workers will be offered “returnerships”, meaning flexible skills training that takes into account previous experience, with a further 8,000 “skills boot camp” places added to the 56,000 currently on offer.

The Telegraph reports the bootcamps will be run in conjunction with local employers, allowing people to learn skills in areas where there is a shortage in the labour market, with time for training reduced when previous experience is taken into account.

Hunt had promised in January to help get the long-term sick back to work: “To those who retired early after the pandemic or haven’t found the right role after furlough, I say – Britain needs you”.

State pension age changes

The state pension age is currently set at 66, but will rise to 67 between 2026 and 2028. The government is understood to be in talks to bring the increase to 68 forward, a plan which the chancellor could announce in the coming budget.

Tax

Next month, corporation tax is due to increase from 19% to 25% on profits over £250,000.

The change, first announced by Rishi Sunak in his 2021 Spring Budget as chancellor, is expected to bring in around £12bn per year to the Treasury, according to government projections.

Despite calls from the right of the Conservative party to cut taxes, Hunt is widely expected to keep the planned increase.

Expect the chancellor to reaffirm that cutting inflation is his priority.

However, Bloomberg reported on Saturday that Hunt will hand businesses a three-year tax break worth £11 billion by replacing the UK’s investment allowance with a temporary measure.

Meanwhile, income tax and national insurance are expected to remain at current levels. Rishi Sunak has vowed to cut personal taxes as soon as the economy gets into better shape.

Net Zero?

With the global race to net zero speeding up, headed by the $369bn Inflation Reduction Act in the US and the EU’s Net Zero Industry Act packages, the UK may wish to announce a net zero technologies investment incentive plan of its own.

The UK Government has already increased targets for offshore wind and nuclear reactors. It has also lifted the ban on onshore wind subject to “local consent”.